Bloomberg — With shares skyrocketing since its trading debut, Airbnb Inc.’s (ABNB) initial public offering was well-timed. That rally shows little sign of abating.

It has soared 135% since it went public in December 2020. The timing was auspicious: Covid-19 vaccines were just arriving, sparking a revival in travel and also demand for lodging where travelers could isolate more easily than in a hotel. Employees also embraced a work-anywhere environment, encouraging the use of temporary homes.

And investors have more reasons to stay bullish. Airbnb’s stock is expected to climb by an average of 24% over the next 12 months with a majority of the 41 analysts covering the firm recommending investors hold on to their shares or buy more, according to data compiled by Bloomberg.

“It is evolving, and becoming an interesting play with respect to work-from-home and long-term rental trends,” said Thomas George, a portfolio manager at Grizzle Investment Management, which owns the stock. “Those are additional levers it can unlock for growth.”

Brokerages on average predict the company next month will report a 64% jump in first-quarter sales. Airbnb, which was profitable on a net-income basis the past two quarters, probably lost money again in the first three months of this year, analysts say.

Its revenue grew 78% to $1.53 billion in the fourth quarter, beating analysts’ projections as people spread out over thousands of towns and cities and stayed for weeks and months with workers no longer having to be in traditional offices five days a week.

“The benefits seen over the past year or so are expected to continue, especially as traveling increases with the pandemic hopefully continuing to wane,” said Scott Kessler, an analyst at Third Bridge.

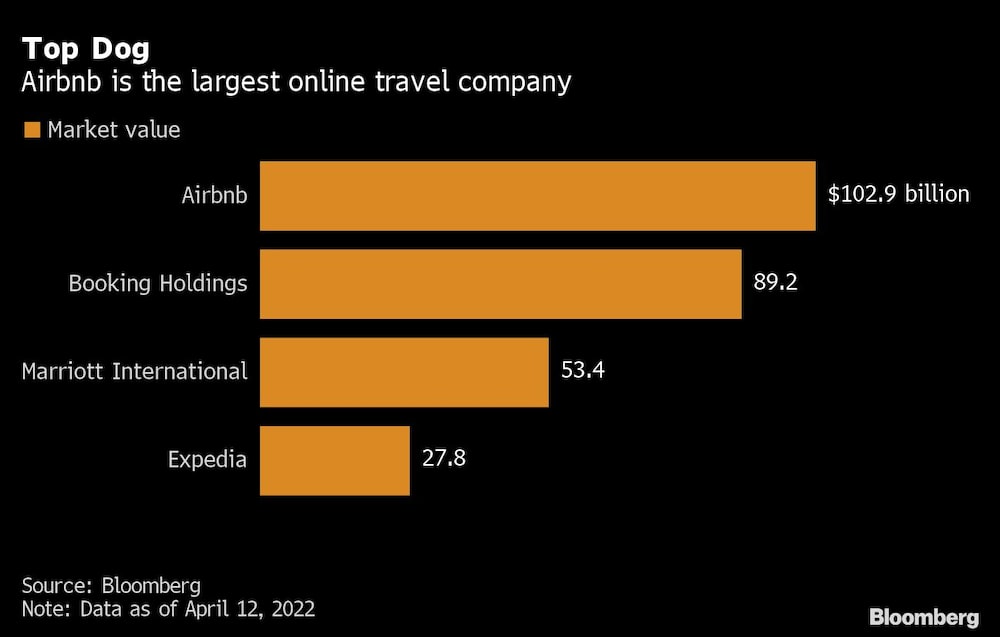

Airbnb’s stock performance also has given it the title of best performer of any IPO to raise $1 billion or more since its debut, according Bloomberg data. This comes at a time where weak trading in recent IPOs has weighed on the listings pipeline. At $103 billion in market value, it’s now the biggest online travel company, eclipsing Booking Holdings Inc., Expedia Group Inc. and Marriott International Inc.

Some caution is warranted. Its stock rally has surpassed its peers by a mile in the travel industry since it went public, which could mean its upside is minimal. Booking has climbed 3.5%, Marriott is 25% higher and Expedia is up 39% in that time period.

And it isn’t cheap. Airbnb sells for about 12 times its estimated sales. That’s well above its peers with Booking sitting at 5.3, and both Expedia’s and TripAdvisor’s are below 3.

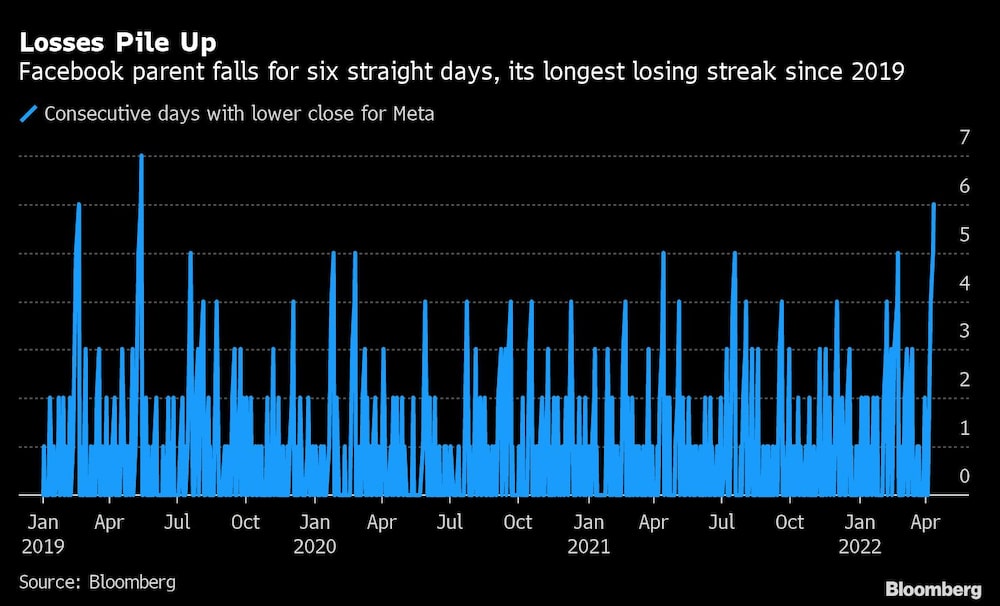

Tech Chart of the Day

The cloud continues to darken around Facebook parent Meta Platforms Inc. (FB) Its shares fell 1.1% on Tuesday, rounding out a sixth day of losses. Its losing streak, which has erased $55 billion in market value, is its longest since May 2019. All eyes will be on the company’s quarterly results slated for April 27, where investors will be looking for any guidance on future growth and its metaverse strategy.