Bloomberg — As investors sorted through emerging markets at the start of the year on the lookout for potential disasters, Bolivia and Ecuador were low on their list of worries.

Despite their rocky political histories and a tendency for social unrest, the Andean nations appeared stable. Their bonds were priced at the highest levels in months in January after getting a lift from the emerging-market exuberance that began the year.

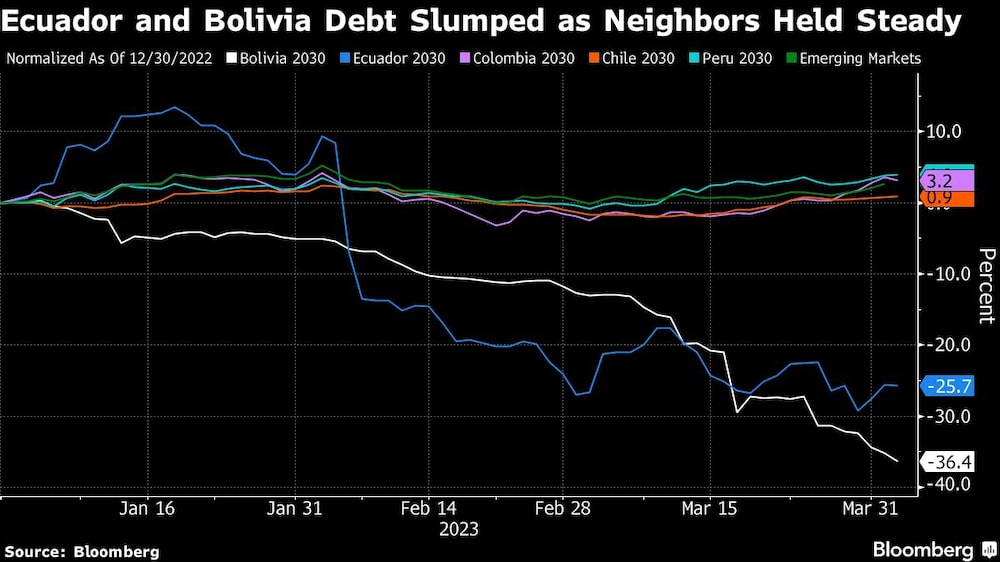

Since then, the trades have blown up in spectacular fashion. Benchmark notes from the countries have lost more than a quarter of their value, making them the worst performers among developing nations this year.

The meltdowns burned some of Wall Street’s biggest banks — with Bank of America Corp. (BAC) and Morgan Stanley (MS) making wrong calls on Ecuador — as they missed warning signs that had been brewing since last year. It’s a reminder of how quickly risky bets in emerging markets can implode when investor sentiment shifts.

“This is a cautionary tale,” said Gary Kleiman, a senior partner at Washington-based Kleiman International Consultants Inc., who said he advised clients to “fade” the countries last year because of the risks. “The signs have been simmering all along.”

The collapse began in February.

That’s when Ecuadorian voters unexpectedly defeated referendums that had been put forth by President Guillermo Lasso, one of Latin America’s few market-friendly leaders. Bonds plummeted 10 cents to 60 cents on the dollar, Barclays Plc cut its recommendation on the debt to neutral from buy and Ecuador went from one of the best performers among Latin America sovereign debt to one of the worst.

The reaction wasn’t so much about the specific proposals — the highest profile of which would have allowed for the extradition of organized crime leaders — but instead sprung from the idea that Lasso didn’t have the political standing analysts had thought. Soon after the vote, the president’s opponents quickly mounted a campaign to oust him for graft charges.

Cracks in his ability to govern became evident starting with massive protests by indigenous groups in mid-2022, said Patrick Esteruelas, head of research at Emso Asset Management. He, along with strategists at JPMorgan Chase & Co. (JPM) and Banco Santander SA (SAN), was among the voices urging caution on Ecuador.

“Lasso’s political capital has been on a steady decline since the protests broke out in June last year, with every political actor in Ecuador smelling blood since,” he said.

Bank of America and Morgan Stanley declined to comment on their Ecuador recommendations.

Notes due in 2030 traded at about 48 cents on the dollar on Tuesday, down from as high as 73 cents in mid-January. The country’s history of defaults — the most recent coming in 2020 — has added to investors’ pessimism.

In the short-term, “it’s hard to see any positive catalysts that will push these prices higher,” Esteruelas said.

Lasso denies the graft charges. Lawmakers are set to decide on impeachment over the next six weeks, but investors are already assuming Lasso will cut his term short and call snap elections. The eventual winner may be a populist, ultimately putting more pressure on the economy.

“If we were to see a headline over the next weeks, where Lasso calls for snap elections, it could lead to some more downside” on bond prices, said Sarah Glendon, a senior analyst at Columbia Threadneedle Investments in New York.

Next door in Bolivia, the year began in quiet fashion, with its overseas debt trading at about 80 cents on the dollar as officials sought to increase exports of natural gas and other hydrocarbons.

But Bolivia has been bleeding international reserves as the government spends heavily to defend its dollar-pegged currency, the boliviano. Natural gas revenue that had been slowly declining and high budget deficits caught up with the country. Reserves plummeted 20% last year alone, and Bolivia hasn’t reported its holdings since saying it had $3.5 billion as of Feb. 8.

Few in the bond world seemed to pay attention until residents started lining up in front of the central bank in La Paz to withdraw US dollars. Bonds due in 2028 plunged to around 51 cents as of Tuesday.

“The fixed exchange rate policy has gradually dwindled reserves to a critical level,” said Sergey Goncharov, a money manager at Vontobel Asset Management Inc. in New York, which holds Bolivian debt.

Despite their own cloudy politics, other Andean countries — Peru, Chile and Colombia — outperformed in the first quarter. They posted a return of 3%, compared with 1.9% across emerging markets, according to data compiled by Bloomberg.

Jared Lou, a money manager at William Blair, said that social unrest in both Ecuador and Bolivia makes it hard to predict how they will be governed going forward.

“In Ecuador, protests and domestic politics have crippled his government, leading to speculation about when Lasso will be forced from office,” he said. “And we are concerned about Bolivia’s ability to muddle through unless there is a near-term change in the policy mix.”

--With assistance from Maria Elena Vizcaino

Read more on Bloomberg.com