Bloomberg — Mexico’s new central bank chief Victoria Rodriguez, who was catapulted from little-known technocrat to the most powerful woman in Latin American finance, is being tasked with taming the nation’s biggest inflation problem in two decades.

President Andres Manuel Lopez Obrador appointed Rodriguez, who oversaw Mexico’s 6.3 trillion peso ($303 billion) budget as deputy minister for expenditures, in November. Since then, inflation has reached 7.3%, and the economy only narrowly dodged a recession at the end of last year.

“It will be a baptism of fire,” said Ernesto Revilla, a former chief economist in Mexico’s Finance Ministry, now at Citigroup Inc. “It’s a very difficult year to take charge of the boat.”

Rodriguez has the added challenge of proving herself in a new role when skeptics have already voiced concern over her lack of experience in monetary policy and possible government interference in the central bank, known as Banxico.

“With zero experience in monetary policy and your first monetary job is the country’s most important position in the subject, you have no option other than to learn fast,” said Valeria Moy, director of the Mexican Institute for Competitiveness, or IMCO, an economics think tank based in Mexico City.

Rodriguez, a more than two-decade veteran of public service, earned a master’s degree from the prestigious Colegio de Mexico in Mexico City and joined the Mexico City Finance Ministry in 2001, when Lopez Obrador was mayor. At the time, she organized a debt sale that was seen as a novelty for local administrations, allowing her to work with financial markets. She stayed in city government until 2018.

Banxico’s press office declined multiple requests for an interview with Rodriguez or to provide comments for this story.

Like the president, Rodriguez has a reputation as a fiscal hawk. Since she started the role on Jan. 1, she has moved fast to establish her inflation-fighting credentials, and scratch the idea that she’ll be beholden to a government that has criticized Banxico in the past.

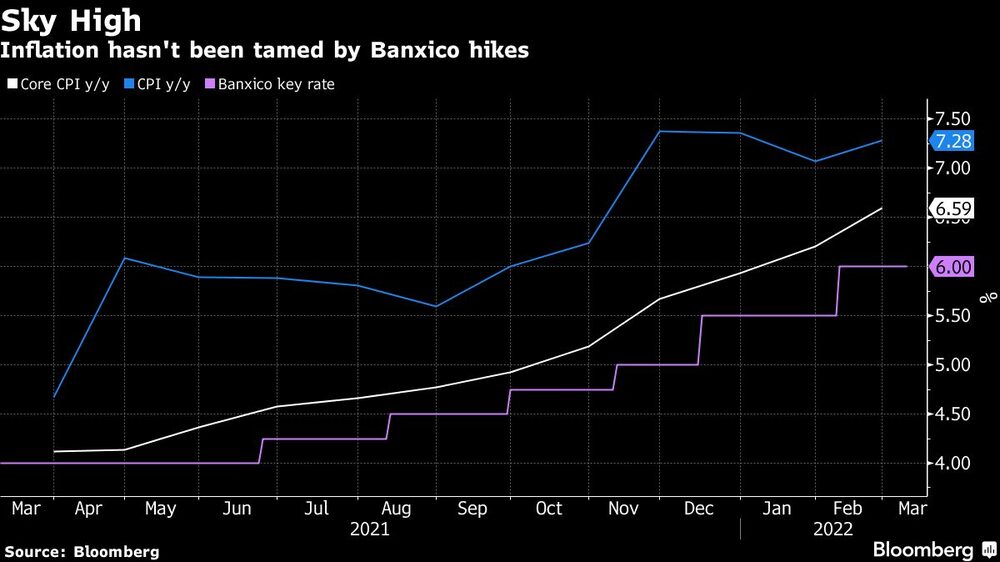

She has taken every chance at public events and internal meetings to repeat the mantras of Mexican central bankers: The bank’s autonomy is key and taming inflation takes precedence over everything else. In her first interest rate decision at the helm last month, Rodriguez reassured investors by siding with the board’s majority in announcing the bank’s second-straight half-percentage point hike. That is in line with the expectations that the bank will raise rates to above 7% by year end despite the weak economy.

The new central bank governor, the first female chief since Banxico’s founding in 1925, had a reputation as a workaholic in her previous job at the Finance Ministry and is laboring nights and weekends to learn the role, said a central bank official who isn’t allowed to speak publicly. The bank’s staff have used meetings to brief her on several topics including monetary policy, financial regulations and Banxico’s operations, the official said.

Fighting Inflation

Lopez Obrador’s comment in May 2021 that he wanted a governor with a “social dimension” had many wondering whether Rodriguez might drag the famously conservative bank in an unorthodox direction.

So far, there is little sign of that. Asked about the remark, Rodriguez said inflation hits poorest Mexicans the hardest, so this was another reason to keep consumer price increases close to the target.

“Inflation mainly affects people with few resources,” Rodriguez said on March 2, defending the central bank’s efforts to control inflation. “With this commitment we will have an impact on this low-income population.”

She also appears to be driven by a pragmatic attempt to control inflation instead of the usual dovish-hawkish division seen among policy makers, according to another Banxico official.

“She arrived and told us off the bat she’s not a member of any political party,” Banxico Deputy Governor Jonathan Heath said in an interview. “She has always been, I would say, almost a technocrat-type person.”

When the pandemic drove the economy into free-fall in 2020, Banxico slashed rates to stimulate the economy, while Lopez Obrador declined to take on more debt. With inflation now at more than double the central bank’s 3% target, Banxico has cut back stimulus with six straight hikes starting in June, with rates now at 6%.

The rate rises have drawn criticism from some Mexican economists who argue they are causing needless pain to an economy that has stalled, when the inflation crisis is a global phenomenon beyond Banxico’s control.

Whatever her views, Rodriguez may find an extra hurdle in the fact that the U.S. Federal Reserve started its own rate increases on Wednesday. Banxico has often matched its northern neighbor to prevent destabilizing outflows of cash from traders who put money in Mexico to take advantage of the difference between the countries’ rates. If Banxico, which has scheduled its next rate meeting for March 24, allows the gap to narrow, it will likely weaken the peso (USDMXN) as some of that money exits.

“No one’s going to want that because depreciation can cause even more inflation,” IMCO’s Moy said.

While Rodriguez continues gaining credibility with investors, she may be forced by the Fed’s actions to keep tightening policy, whether she wants to or not, Moy said.

— With assistance by Maya Averbuch

Also read: