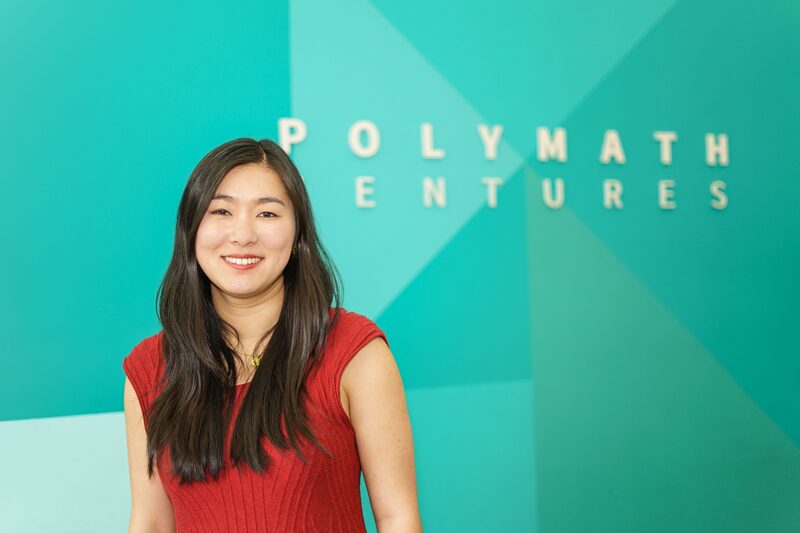

Bogotá — In an interview with Bloomberg Línea, Wenyi Cai, the Chinese founder and CEO of Polymath Ventures, shares her vision of what Latin America can learn from the startup ecosystem in her country.

Wenyi founded Polymath Ventures in Colombia, and which helps build companies in emerging markets with a focus on the middle class, and which has a portfolio valued at approximately $150 million.

Polymath Ventures has helped build 11 companies, of which nine are based in Colombia and two in Mexico, and aims to help launch two more this year.

Renowned startups in the country such as Elenas, a platform that digitizes catalog sales, and Autolab, a network of mechanical workshops, among others, form part of the portfolio.

Following is Cai’s vision of China’s startup boom, and which has so far sprouted more than 300 unicorns, with recent success stories such as ByteDance.

1. Adapt to the Local Market

The owner of Polymath Ventures explains that there are several interesting aspects of what happened in China in the 2010s, among which, she says, the Asian giant originally copied from the U.S., although the most successful startups were significantly different from those in the U.S.

One of the lessons is to build businesses that make sense in the market they are in, she says, and that the Chinese startup ecosystem in particular grew because of its focus on the middle classes.

It also helped for companies to not focus only on major cities, which are considered tier one or two, but also on smaller territories.

And in this respect, she says, Latin America has an advantage, because it is “actually a little more urbanized than China”, and “relatively homogenous” compared not only to that market, but also to Southeast Asia or the Middle East.

“I think Latin America will have to grapple with the business model changes necessary to really serve the mass market and populations outside of tier-one cities,” she says.

2. Understand the Online and Offline Worlds

Another aspect that stands out about the Chinese startup ecosystem is the understanding it had of the importance of exploiting not only the digital world, but also completing tasks that needed to be done in the physical one.

“Big companies such as Alibaba Group from the beginning were driven by field sales, and it is not something that is talked about a lot in the Western media, maybe because in the U.S. it is something that is not really necessary, where the most common sales teams come from SaaS companies,” she says.

This is why she believes that Latin America requires more of that combination between efforts in the digital world and face-to-face, “to get a lot more out of the online economy”.

“Chinese companies have done a good job of transitioning from offline to online customers, but that has taken a decade and millions of sales boots on the ground,” she says.

3. Create Companies that Are Healthy from the Outset

Wenyi Cai says that one of the challenges that persist in Latin America is that part of the growth of the last two years has been based on raising capital, which should be complemented with other strategies.

“It is much easier to raise capital and increase valuation than to build companies that are profitable and growing in a healthy way. I have no doubt that there will be many great companies built in Latin America, but there is an adjustment that needs to happen right now,” she says.

She adds that the reason she has no doubt that many companies will succeed in the region is because several of these “are run by second- or third-time entrepreneurs, who have managed companies in much more difficult environments.”

4. Develop Entrepreneurial Hubs

Among other points, she refers to China’s diverse innovation centers, such as Beijing, Shanghai, Hangzhou and Shenzhen, each with different characteristics.

The Beijing startup ecosystem, for example, is more focused on internet startups, and concentrates most of the venture capital firms.

Hangzhou, where Alibaba Group is located, is specialized in e-commerce, while Shanghai has been more of a financial center. Shenzhen, on the other hand, is focused on manufacturing, so many hardware startups are there.

In the case of Latin America, she applauds the fact that the region already has some startup hubs, such as São Paulo or Mexico City, which in turn connect with the U.S. in Miami, which “is also beginning to show itself as an interesting hub for the region’s startup ecosystem”. And Bogotá and Medellín in Colombia “are starting to become relevant, but I don’t think they can become hubs in the short term”, she says.

Asked whether these hubs will adopt different characteristics, as in China, she says she does not believe so, but rather they will be driven by market forces.

5. The Importance of Local Venture Capital

Wenyi Cai also points to the importance of having a network of local venture capital funds in the startup ecosystem, since “there are many businesses in Latin America that foreign investors would not understand”.

“Elenas is a very good example. In the United States there is no need for social commerce in the way Elenas handles it, but in Latin America there is, because of the traditional direct sales industry, how problematic it is, and how middle-class people use it as an alternative source of income,” she says.

This is why she believes that it would be more difficult for such companies to finance themselves if the majority of the capital comes from outside, as well as to grow properly in the case of those in the initial, pre-seed phase.

“For example, if you are a Colombian company and you get a pre-seed round from an international venture capital fund, often you have to promise to expand to Mexico, because of the size of the market, etc., even though sometimes it doesn’t make sense to expand to that country or to expand at such an early stage.”