Bloomberg — Brazilian families spend almost a third of their monthly wages paying off debt, just as central bankers are likely to hold interest rates at a six-year high for most of the year.

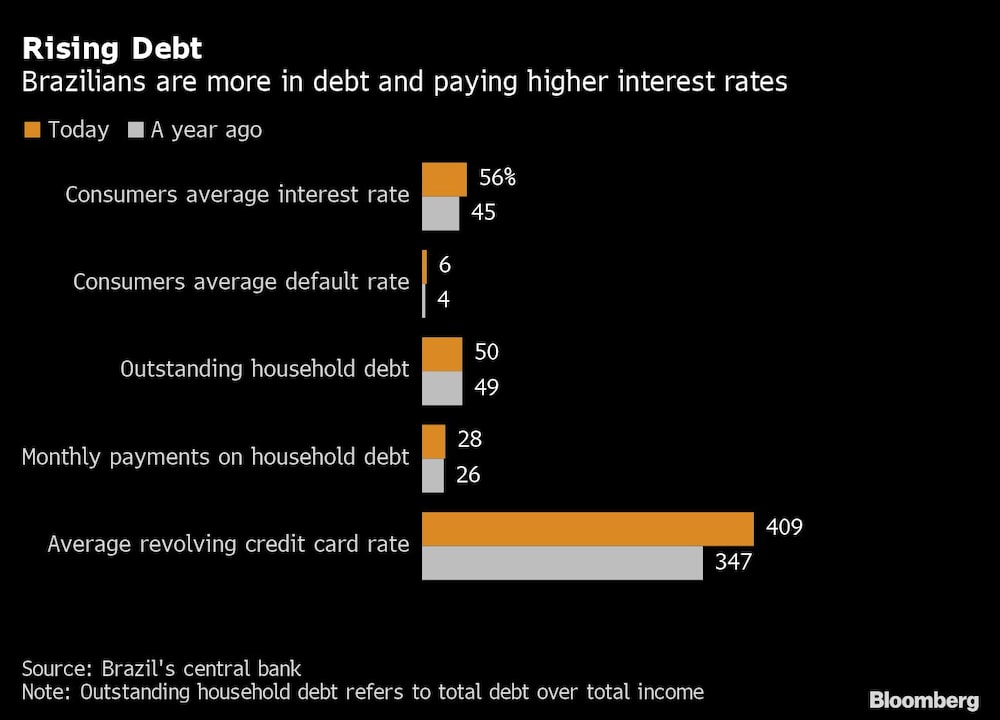

Monthly credit payments in November hit 28.2% of families’ wages, the highest figure in the dataset that goes back to 2005, according to central bank data published Friday. Outstanding debt, including credit card bills, mortgages and all types of loans, hit 49.5% of families’ total income, slightly lower than July’s peak of 50.1%.

Policymakers led by Roberto Campos Neto are holding interest rates steady at 13.75% even as consumer price increases eased the most among major emerging economies last year. Yet, uncertainties around Brazil’s fiscal outlook and concern about government spending under the new administration of Luiz Inacio Lula da Silva have all but scuttled bets on rate cuts occurring anytime soon. Lula’s thinly-veiled attacks on the central bank’s autonomy and inflation targets have also boosted inflation expectations, which are now above target through 2025.

Default rates remain at single digits, though are rising. Consumers’ average delinquency rate hit 5.9% at year-end 2022, one and a half percentage points higher than a year earlier. Families are also failing to pay the most expensive loans. Non-payment on revolving loans — when credit card bills aren’t paid in full — hit 44.7%, the highest in the dataset that goes back to 2011. Default on overdrafts hit 13.4%, the highest since September 2020.

Central bankers warned about “high” levels of household debt in their latest inflation report. Yet, at the same time, central bank chief Campos Neto in November said that stress tests pointed to a “very healthy” banking system.

“Most of the increase in household loans last year was through loans with lower interest rates,” said Fernando Rocha head of statistics at the central bank, on a presser on Friday.

Read more on Bloomberg.com