Bloomberg — Brazil’s hedge-fund industry is diving deep into credit as higher interest rates attract investors and government-owned banks pull back on cheap, subsidized loans to corporations.

Vinland Capital Management Gestora de Recursos Ltda. and Occam Brasil Gestao de Recursos Ltda. are among hedge funds planning to offer credit products after the nation’s benchmark interest rate jumped to almost 14% from 2% last year, luring investors back to bonds.

Local fixed-income funds posted net inflows of 106 billion reais ($20.5 billion) this year through August after raising 232 billion reais for all of last year, according to Anbima, the capital-markets association. And this time they’re not buying only Treasury bonds as in the past, but are starting to hold more corporate debt -- mostly high-grade, but also high-yield and distressed -- and financing infrastructure projects, fintechs, small firms and agribusinesses.

“This is a great revolution for Brazil’s financial system,” said Daniel Sorrentino, managing partner and country manager for Brazil at Patria Investments Ltd., an alternative-investment firm with $26.3 billion under management in Latin America. “Now I don’t need a big bank to get a loan in Brazil -- I have other alternatives. And this direct connection between the investor who will provide the financing and those who need it is being made by fintechs, brokerage firms and independent asset managers.”

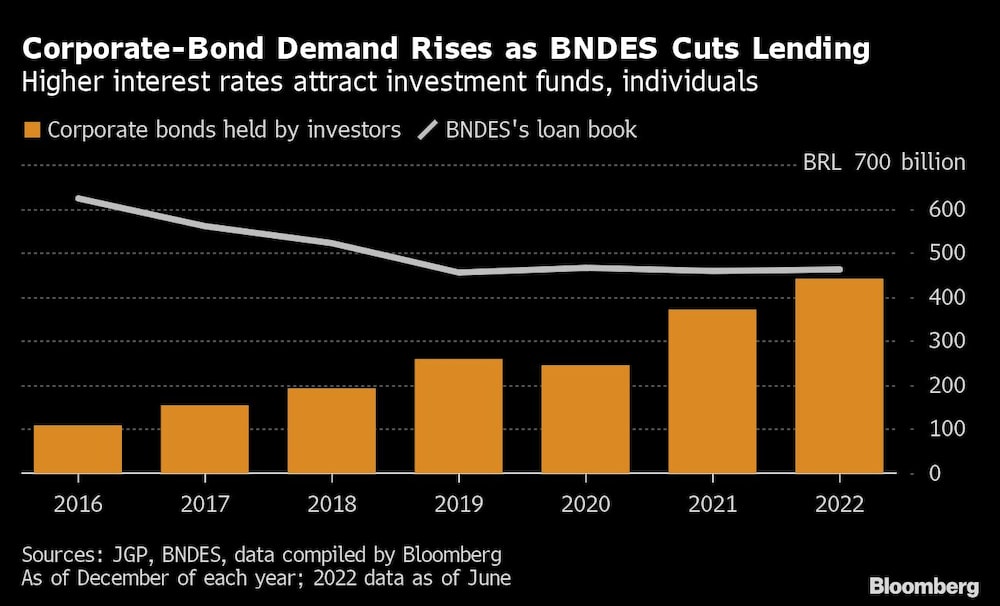

The result is that, for the first time ever, investment funds along with individual investors are buying a meaningful amount of corporate bonds -- almost as much as the loan book at government-owned development bank BNDES, which used to be one of the main sources of funding for Brazilian firms. As of June, investors held 442 billion reais in those securities, 82% more than two years ago, according to JGP Gestao de Recursos Ltda. BNDES has a loan book of 463 billion reais, 40% below its peak in 2015, according to its financial statements.

“The government reduced subsidies to corporate financing in Brazil, cutting the volume of new lending from its banks and bringing BNDES’s interest rates to market levels,” said Alexandre Muller, a partner and portfolio manager in Rio de Janeiro at JGP, which has 1.3 billion reais of credit funds under management. “The credit markets replaced them and are booming.”

As funds and individuals buy mostly floating-rate credit, more brokerage firms are trading it, and independent financial advisers are bringing more transactions directly from companies to the market, Muller said, adding that secondary markets are also developing.

It’s not just government-owned banks that have been shrinking financing to big corporations, according to Daniela Gamboa, head of private credit and real state at SulAmerica Investimentos. The nation’s biggest banks face more restrictive capital requirements, and are favoring individuals over big companies because retail clients offer more attractive spreads.

SulAmerica has about 13 billion reais in fixed-income funds with more than 50% of its holdings in corporate credit, compared with 5 billion reais about two years ago. For the whole industry, those types of credit funds had 17 months of consecutive inflows through July, according to JGP.

Most clients still seek funds that allow them to withdraw money on the same day or the day after a request, and they typically hold liquid, high-grade corporate bonds, Gamboa said. But longer-term, sophisticated strategies are being brought to the market every day, she said.

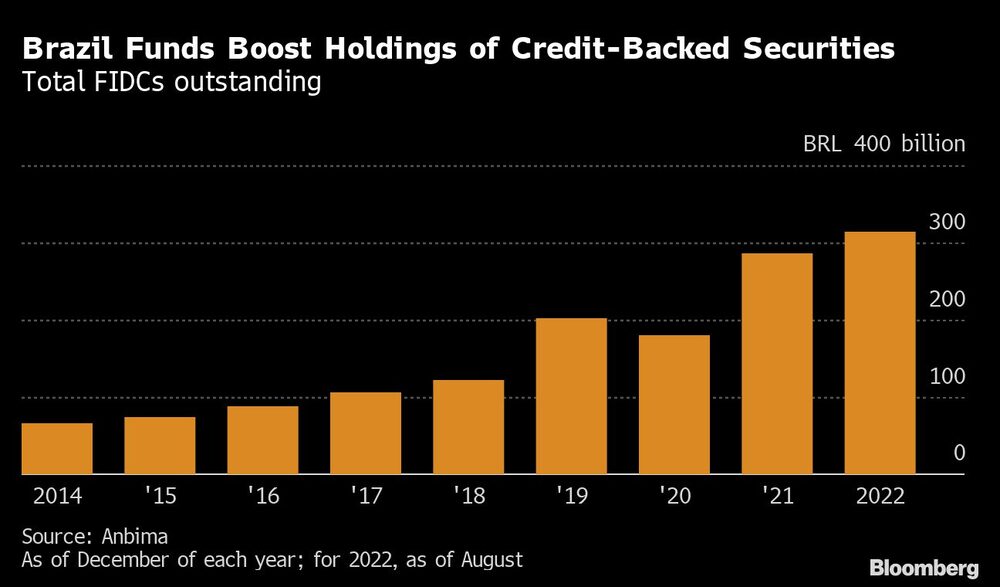

Financial-technology companies are also able to obtain financing by selling credit-card or even car loans directly to credit funds, using structures such as FIDCs, funds that buy credit-backed securities. The amount of FIDCs rose to a record 313.2 billion reais in August, a 10% increase from December, according to Anbima. Those structures are also used by longer term funds that specialize in buying agribusiness credit, distressed credit and legal claims. Other firms offer funds that buy asset-backed bonds that are tax-exempt for individuals.

Some funds can offer investors yields as high as 19%, but require waiting periods of 60 to 180 days for withdrawals, said Rafael Fritsch, chief investment officer at Root Capital, a Rio de Janeiro-based firm founded in April that specializes in credit, with 1.7 billion reais in committed capital from clients.

Vinci Partners Investments Ltd., SPX Gestao de Recursos Ltda., Legacy Capital Gestora de Recursos Ltda. and Ibiuna Gestao de Recursos Ltda. are among other Brazilian hedge-fund houses that have started credit-fund strategies or purchased specialized firms. Many new credit-focused asset managers are also being formed.

There is a lot of room for the market to grow, as banks still hold by far the majority of corporate credit in Brazil -- the opposite of how the market in the US shapes up, according to Jean-Pierre Cote Gil, a credit portfolio manager at Vinland.

Some investors fear that the credit-market boom could evaporate if Luiz Inacio Lula da Silva, who leads opinion polls for the Oct. 30 second round of the presidential election, brings back the controversial policy of providing billions of reais in cheap loans to big companies. BNDES’s loan portfolio jumped to a record 700 billion reais in December 2015, following Lula’s previous two terms in office and that of his successor from the same party, Dilma Rousseff.

“I hope that any new government, when elected, doesn’t increase subsidies or loans to corporate credit, in order to avoid asphyxiating the booming capital markets,” JGP’s Muller said.

Read more on Bloomberg.com