Bloomberg Línea — High interest rates hurt Brazilian fintech Creditas’ margins in 2022, but the company improved profitability in the first quarter of 2023 as it slowed down its growth.

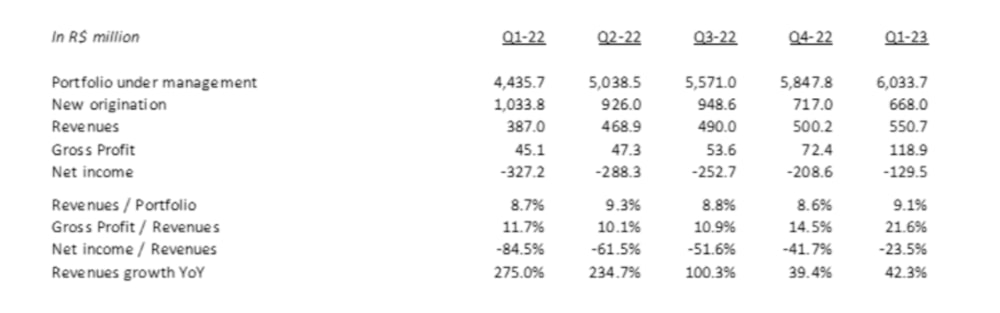

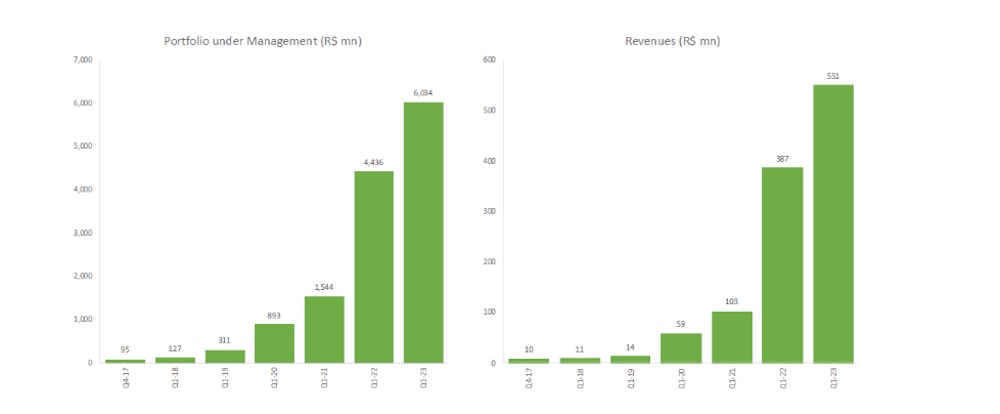

The secured-credit fintech, one of the largest in the country in this segment, had revenue of 551 million reais ($110 million) in the first three months of the year, a growth of 42.3% compared to the same period last year, despite the more adverse market scenario.

Creditas plans to achieve breakeven by the end of the year, before resuming plans to go public through an IPO, if conditions are favorable.

Last year, the increase in interest rates to 13.75% per year - a level at which the Selic has been parked since August 2022 - hindered the fintech’s breakeven plans as the increase in interest rates impacted funding costs, which Creditas pays investors to raise capital.

Now, with the Selic stable, CEO Sergio Furio said the startup was able to expand margins by consolidating the cost of raising capital and passing that on to customers.

In an interview with Bloomberg Línea, Furio said that a focus on financial margins and close monitoring of credit quality allowed the company to improve its gross profit. Gross profit of 118.9 million reais ($23.7 million) in the first quarter represented a 164% increase compared to the same period last year.

The gross profit margin increased from 11.7% to 21.6% in 12 months.

Creditas said that expenses as a percentage of gross profit fell to 248 million reais, 33% lower compared to the same period last year, reducing net losses.

By the end of the year, the fintech hopes to achieve a quarterly gross profit margin of 200 million reais, versus the current 118.9 million reais. The company expects indirect costs to fall from the current 248 million reais to less than 200 million reais, which will allow for breakeven.

In 2022, the company saw revenues of 1.8 billion reais ($359.6 million), a 118% increase compared to 2021.

Creditas’ profitability plan requires that the Selic does not rise further or even be cut. In the median of market expectations consolidated by the central bank’s Boletim focus, the basic interest rate ends the year at 12.50%.

The fintech’s loan portfolio grew 36% in the first quarter of 2023 ,compared to the previous year, despite more restricted origination and a less aggressive growth approach.

SoftBank-funded Creditas has 70% of its loan portfolio linked to fixed interest rates. The repricing of fixed-rate loans for new originations remained almost stable in the first quarter of 2023 at 57%.

The repricing of the fixed-rate portfolio continued to increase in the first quarter, rising from 32% in September 2021 to 43% in March 2023. “This trend will continue until 2023, as the deterioration of our fixed-rate portfolio is replaced by new loans with new rates, accelerating gross profit expansion,” the fintech said in a statement to shareholders.

Creditas’ results in recent quarters:

The fintech reduced customer acquisition costs because it decided to grow more slowly.

Expenses fell, giving greater operational leverage capacity to the credit unicorn. However, according to Furio, in the second quarter, the company is expected to see lower gross profit because there are fewer days in the period.

“We implemented a credit policy restriction to be more conservative. We set a growth pace that we are comfortable with,” said Furio.

Last year, the fintech acquired the Brazilian subsidiary of European bank Andbank to strengthen its balance sheet and accelerate deposit growth, diversifying sources of funding to originate credit, not relying solely on the slower-paced capital market.

According to Furio, the Credit Rights Investment Funds (FIDCs) are “performing well”. Creditas’ latest issuance was a listed Real Estate Receivables Certificate (CRI) with Kinea, worth 400 million reais. In total, the company has 35 securitization vehicles.

Creditas was valued at $4.8 billion after receiving an investment from US investment giant Fidelity in January 2022.

But later, Kaszek and Redpoint reportedly revalued the startup at $3.5 billion and $2 billion, respectively, according to Valor Econômico’s Pipeline.

Furio said he doesn’t comment on market valuations, noting that many companies have gone through this in the last year. “It’s something that happens in the market as a whole,” he told Bloomberg Línea.