Bloomberg — Enel SpA plans to sell assets worth as much as €21 billion ($22 billion) to cut its record debt pile, leading to exits from markets in South America and Europe.

Italy’s biggest utility, which issued a profit warning earlier this month, is struggling with rising debt after an acquisition spree to boost renewable energy production. Enel has also in the past few years been hurt by soaring costs amid the energy crisis, droughts cutting hydro power output and lower demand because of the pandemic.

There are still challenging times ahead, Chief Executive Officer Francesco Starace said Tuesday at a strategy presentation, citing both high gas prices and government action to deal with the crisis. He said he’s expecting “at least a couple of years of turbulence,” and as a result, the firm is “taking a more conservative approach.”

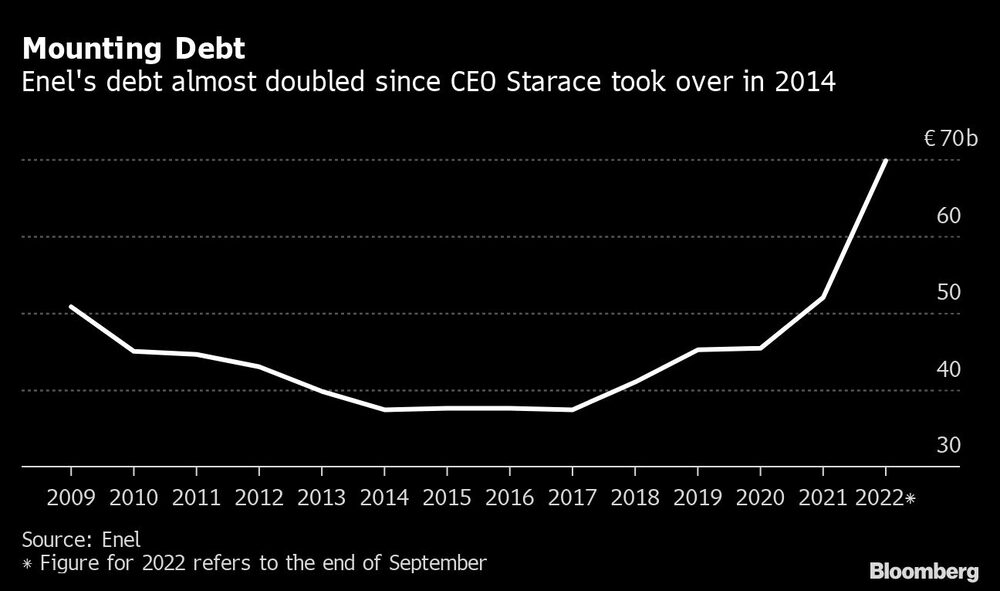

Enel’s debt was €69.7 billion at the end of September. Assets that will be put up for sale will result in full exits from Argentina, Peru and Romania. It will now focus on six major markets from Italy to the US and Brazil.

Bloomberg News reported earlier this month that Enel was working on a disposal plan, including a potential sale of its Peru operations. The Peru assets, which could be valued at about $5 billion, have already attracted interest from strategic suitors and investment funds, a person with knowledge of the matter said at the time.

The company’s shares rose as much as 2.9% in Milan to the highest since July 11.

At the start of the month, Enel cut its adjusted net income guidance for this year to €5-5.3 billion as its Italian activities are expected to suffer more than other regional markets from the energy crisis.

The firm aims to cut debt to €58 billion-€62 billion by the end of December, then reducing it to €51-52 billion by the end of next year.

The utility maintained its adjusted net income target for next year at €6.1 billion-€6.3 billion, after reducing its guidance earlier this month citing the impact of the energy crisis.

Starace, 67, said he may seek a fourth mandate to head the state-controlled company when his current tenure ends next spring. Under his leadership, Enel’s market value has increased 32% to €51.7 billion as of Monday.

Read more on Bloomberg.com