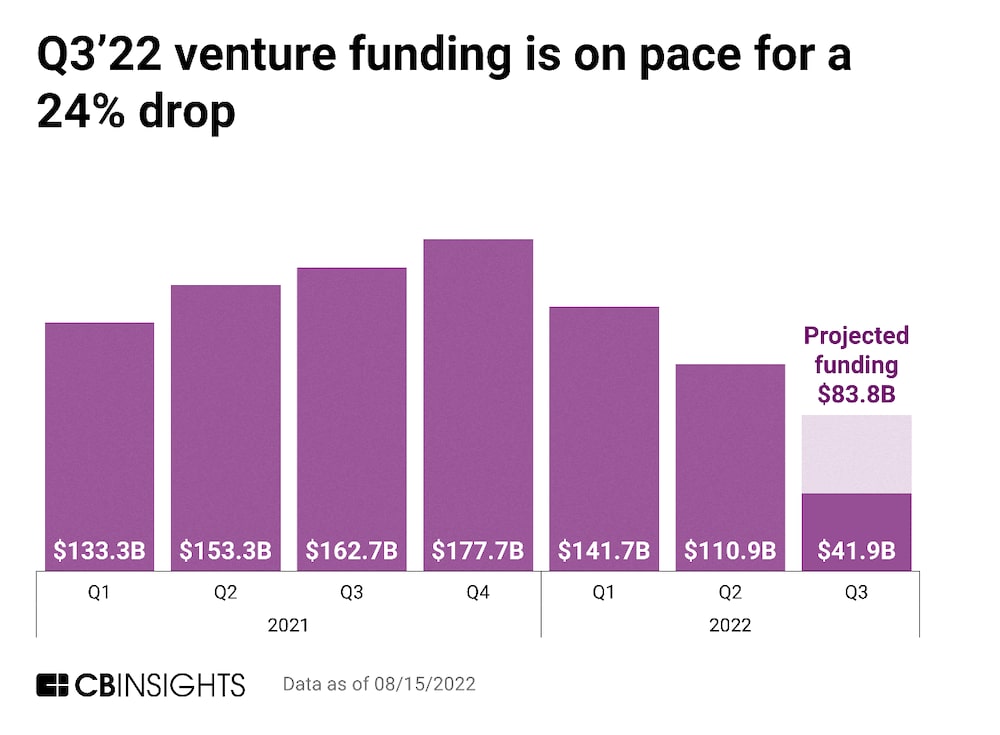

Bloomberg Línea — Global venture funding for third quarter has so far totaled $41.9 billion, totaling $110.9 billion in second quarter, a drop from the $141.7 billion invested in the first quarter of the year, according to a report by CB Insights.

At this pace, CB Insights estimates that Q3 funding is on track to decrease by 24% from the second quarter.

These were the companies that raised funds in Latin America this week:

Capitalizarme

Capitalizarme, a Chilean fintech operating in the proptech arena, received $6 million in bridge capital from investors including Angel Ventures and some Chilean family offices. The company had previously raised $1.5 million in a round in which Chilean fund Aurus and Nazca participated.

Founded by Gabriel Cid in 2014, Capitalizarme works as a marketplace, like Amazon (AMZN) or Mercado Libre (MELI), but for real estate assets.

Capitalizarme has encountered two main barriers along the way, however. The real estate industry is very traditional, and transactions are still very manual, in the sense that they require many documents. And, historically, it is a process in which a number of agents participate in the sale and purchase, while digitization of that process has been a big challenge, in addition to the lack of financial education among the population, Tomás Denecken (Chief Investment Officer) told Bloomberg Línea.

As of 2019, and as a result of the proptech boom, the Chilean startup has grown 100% and currently has an active community of more than 500,000 customers. With the capital raised, Capitalizarme will focus on its growth in Mexico, the country it chose to start its internationalization.

Fudo

Argentina-based Fudo raised $7.5 million in a seed round in which a16z, Atlántico, and Maya Capital participated. Collaborative Fund, Goodwater, and Latitud also joined the round. The startup offers a restaurant operating system and software to manage tables, deliveries, and financials, a similar business to that operated by Brazil’s ZAK (which has been facing a tough financial situation of late) and Colombia’s Pirpos seek to capture.

Investo

About to complete one year of operations in the Brazilian market, Investo, a fund manager specializing in exchange traded funds (ETFs) in Brazil, has announced a new $8 million round. Among the main investors is US-based Van Eck Associates Corporation.

Founded by Cauê Mançanares, Luiz Junior, and Gabriel Lansac, Investo launched its first fund in July 2021 intending to help Brazilians become global investors through low-cost and transparent investments. The company’s main focus is on ETFs, whose shares are traded on the Brazilian stock exchange (B3) for minimum investment values ranging from 10 to 100 reais.

Quaddro

With only five months of operation, Quaddro has raised 17 million reais ($3.27 million) in a round led by the Valor Capital Group fund, accompanied by Grão, Bridge Latam and NXTP, along with angel founders of startups such as iFood, Nomad, Conta Simples and Flash.

The platform optimizes the operation of small businesses and professionals. With the funding, it plans to increase the team that is currently made up of four founding partners. In addition to expanding the software’s functionalities, the company expects to grow its customer base and, by the end of the year, enable more than 20 million reais ($3.85 million) in transactions for entrepreneurs who use the application.

Pomelo

Pomelo, an Argentina-based fintech that enables companies to offer their own financial services in Latin America, announced a new investment of $15 million, extending its Series A round to a total of $50 million, and increasing its valuation by 50%.

The company recently started operations in Colombia and Peru, in addition to being present in Brazil, Argentina and Mexico.

Omens

Brazilian startup Omens, a health tech specializing in men’s healthcare, raised 10 million reias ($1.92 million) in a round led by impact investor VOX Capital. Green Rock, Aimorés Investimentos, and Incubate Fund also participated in the funding.

Fluid

A platform for integrating systems, Brazil’s Fluid announced it has raised 3.3 million reais ($635,923) in a round led by Brazilian early-stage venture capital firm DOMO Invest, with participation from URCA Angels.

Syntage

After receiving an investment of $4.3 million in seed capital, Satws is evolving to become Syntage, an integral data platform (open data and open finance) for businesses that through aggregation and enrichment of data from different sources, allows its clients to access transactional, financial and qualitative information from other businesses through APIs and web interface.

“We are working on new features and data sources that will be launched in fourth quarter under the Syntage name,” said Matheus Pedroso, co-counder and CEO of Syntage, in a press release.

Syntage provides the technology that powers the creation of business-driven products and services, such as financial services, payment solutions, and SaaS. With the new investment, Syntage will make enterprise data more accessible in Latin America and consolidate its team. The platform is aimed at companies seeking to digitize their processes for accessing and analyzing information from other businesses.

Rebill

Argentina-based startup Rebill raised $3.6 million to continue building automated billing and subscription management tools for Latin America.

The capital is made up of an earlier S$600,000 pre-seed round and a $3 million extension led by Tiger Global Management and included Y Combinator, Soma Capital, SV Angel, and a group of angel investors, including Dropbox co-founder Arash Ferdowsi and Vercel founder Guillermo Rauch.

Rebill CEO Nahuel Candia had the initial idea for Rebill in 2018 when he was consulting for an insurance company in Argentina. He then teamed up with Ariel Díaz Ailán, an e-commerce expert, to create Rebill in 2020. Rebill was part of Y Combinator’s Winter 2022 cohort.

Rebill’s also offers pre-approved credit and debit cards so its customers can get paid without having to contact their customers or create complex billing scenarios.

Loads

Chilean startup Loads raised $500,000 and is a platform to connect local producers with the international market. After this pre-seed capital round, the company aims to send 250 containers with production to Europe, Asia, the United States and the Middle East during its first year, and to have more than 1,000 users.

“At Loads, we accompany the grower from the sowing of the seed to the arrival in new markets,” explains founder and CEO Larry Gil B., who has worked at the unicorn for over a decade, and who previously worked for Chilean unicorn Betterfly. He created Loads after experiencing and witnessing firsthand the lack of transparency for importers and producers in terms of prices and processes, as well as the lack of technology to carry them out.

Loads also provides support in the operational, financial, and logistical process, generating a community in which they can even access education, financing, and new business opportunities.