Bloomberg — Brazil’s consumer prices shot past forecasts in mid-March, pushed up by spiking gasoline and food costs as Russia’s invasion of Ukraine upends global commodities markets.

See how the real compares Vs the dollar (USDBRL)

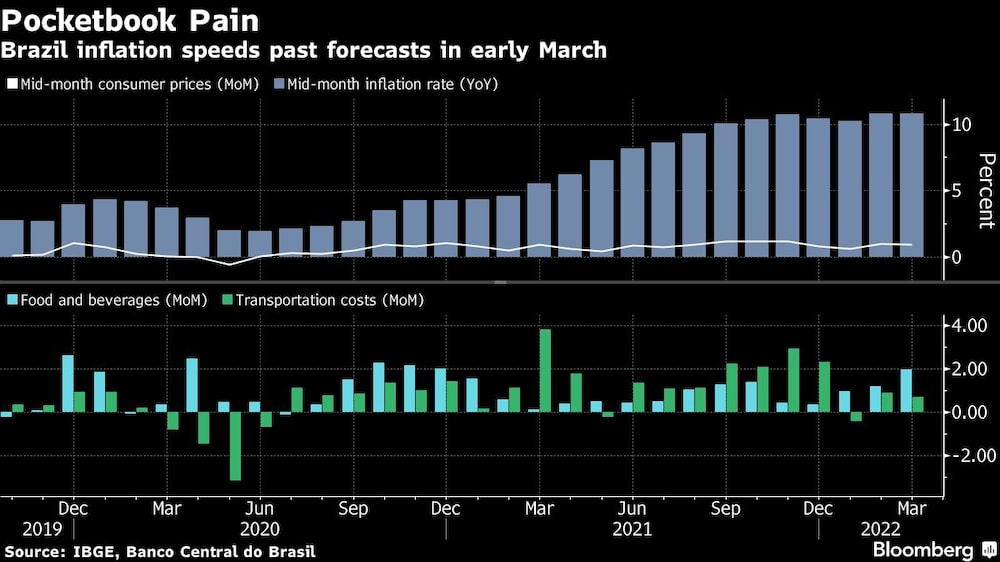

Prices increased 10.79% from a year ago, above the 10.69% median estimate in a Bloomberg survey. Inflation through mid-month hit 0.95%, the national statistics agency reported on Friday.

Brazil policymakers say they’re nearing the end of a tightening cycle that’s lifted interest rates 975 basis points in the past year to battle above-target inflation. Those plans are now being tested as oil skyrocketed over $100 a barrel amid the war in Ukraine, pushing the cost of living even higher.

Food and beverage prices jumped 1.95%, while personal care items rose 1.3% and transport costs climbed 0.68%, representing the biggest contributors to mid-month inflation, the statistics agency said.

On March 10, Brazil’s state-controlled oil company Petroleo Brasileiro SA, which tracks international prices but tries to shield consumers from periods of high volatility, announced that it would hike fuel prices as much as 25%.

After lifting the benchmark Selic to 11.75% earlier this month, the central bank has signaled it plans to increase borrowing costs by an additional percentage point in May before it stops hiking. Bank President Roberto Campos Neto said this week that inflation will peak in April and then ease toward target.

Policymakers target consumer price increases at 3.5% in 2022 and 3.25% in 2023.

But economists warn inflation may stay high for the foreseeable future as the conflict in eastern Europe drags on. “The disinflation process will be slower than we have expected earlier this year, on the back mostly of increased commodity prices,” Andres Abadia, chief Latin America economist at Pantheon Macroeconomics, wrote in a research note on Friday.

The combination of double-digit inflation and tight credit conditions is posing a major drag on the Brazilian economy. Analysts surveyed by the central bank see growth at just 0.5% this year, and 1.3% in 2023.