A roundup of Thursday’s stock market results from across the Americas

👑 Argentina leads in Latin America:

Following the volatile but ultimately positive performance of the US markets, most Latin American stock markets closed the day with gains, and Argentina’s Merval (MERVAL) saw the highest gains, closing with an increase of 3.20%, driven by the hikes in the shares of Mirgor Saficia (MIRG), YPFD S.A (YPFD) and Cablevisión Holding (CVH).

This week, in order to meet the needs of different sectors and to safeguard the central bank’s meager net international reserves, the Ministry of Economy launched two new differential exchange rates: the ‘Coldplay dollar’ and the ‘Qatar dollar’, which are added to the rest of the thirteen official and parallel exchange rates that coexist in the local market.

The Chilean stock market was another of the highest in the region. Chile’s Ipsa (IPSA) closed 0.50% higher after registering the biggest fall in Latin America on Wednesday. The index was buoyed by the materials, communication services and energy sectors.

📉 A bad day for Brazil’s Ibovespa:

Brazil’s Ibovespa (IBOV) was the only Latin American index to close lower, having remained closed for a holiday on Wednesday. Shares of Americanas SA (AMER3), CSN Mineracao (CMIN3) and MRV Engenharia (MRVE3) were among the worst performers.

🗽 On Wall Street:

US stocks roared back from losses sparked by a hot inflation reading on Thursday amid speculation the yearlong selloff had potentially reached a bottom.

The S&P 500 closed up 2.60% after swinging more than 5% during a wild trading day. The benchmark clawed back more than 40% of the losses over a six-day selloff that took it to a two-year low.

The Dow Jones Industrial Average climbed 2.83% and the Nasdaq Composite (CCMPDL) 2.23%.

Technical levels factored into the bounce. At one point, the benchmark S&P 500 had given back 50% of its post-pandemic rally, triggering programmed buying. A wave of put options bought to protect against such a rout moved into the money, and as profits were booked, that prompted dealers to buy stocks to remain market neutral.

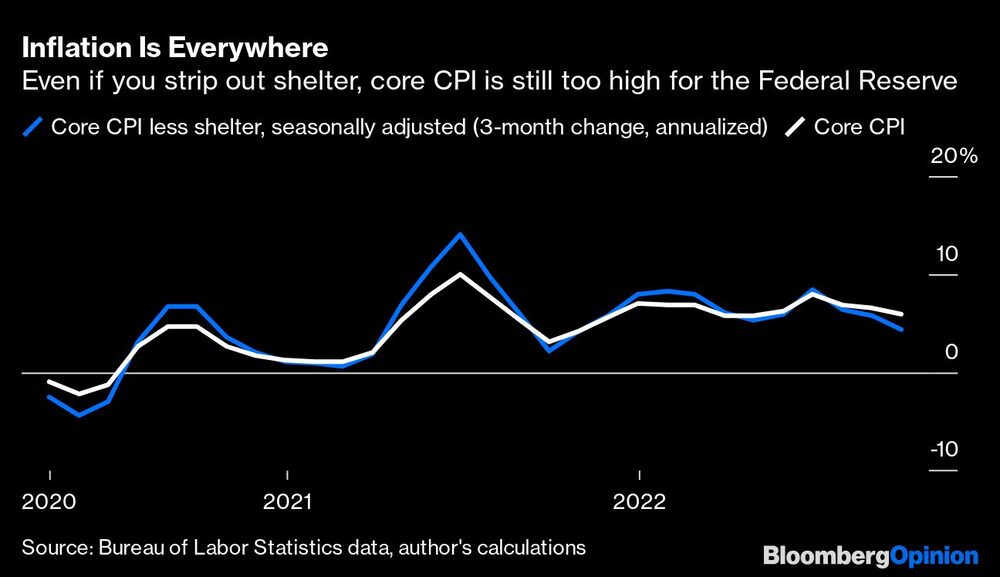

A gauge of consumer price growth rose to a 40-year high last month, sealing the case for the Fed to deliver a large rate hike in November. Stocks plunged 25% this year before Thursday’s rebound, as the central bank tightened policy to curb inflation, leaving investors to weigh how much damage is left for share prices.

“There may be some short covering going on, but also, a lot was priced in,” said Michael Contopoulos, director of fixed income at Richard Bernstein Advisors. “There has likely been a fair amount of defensive positioning lately in equities and on the rates side, higher policy rates means higher probability of a hard landing.”

Risk assets have been under pressure all year as central banks around the world attempt to tame runaway inflation. The latest data added to evidence the harsh monetary medicine has yet to take hold and comes on the heels of last week’s payrolls figures that showed unemployment rate at a five-decade low in September.

The Treasury curve flattened, with the yield on policy-sensitive two-year notes up 18 basis points at 4.47%. Market bets on rates now lean toward back-to-back 75 basis-point hikes at the next two Fed meetings and expect the central bank to push rates past 4.85% before the tightening cycle ends. The current rate is 3.25%.

On the earnings front, Delta Air Lines Inc., Domino’s Pizza Inc. and Walgreens Boots Alliance Inc. gained on better-than-expected results. Big banks including JPMorgan Chase & Co. and Citigroup Inc. are due to report on Friday.

“There’s so much uncertainty in the market and so many data points are conflicting that the market responds to whatever is the most recent data point,” said Ellen Hazen, chief market strategist and portfolio manager at F.L.Putnam Investment Management.

“So this morning with the reversal in the UK the market was up pre-open, then we got CPI and then it was down. And then we look at the fact that we bounced off of this support level and that becomes self-fulfilling,” she added.

Meanwhile, UK markets remained in turmoil almost two weeks after the government unveiled a plan to drastically cut taxes. The pound surged back above $1.13, buoyed by reports that government officials are working on a U-turn of tax cuts. Gilts also rallied, with the yield on 30-year debt dropping as much as 46 basis points.

The yen sank to its lowest level in more than 30 years after the US inflation report, before reversing the move in a whiplash trade that raised market chatter of potential intervention

Elsewhere, oil gained for the first time this week, with crude in New York rising back above $89 a barrel after a US crude report flagged potential bullish drivers, shrugging off inflation data. The International Energy Agency earlier warned production cuts agreed by OPEC+ risked causing oil prices to spike and tipping the global economy into recession.

On the currency markets, the Bloomberg Dollar Spot Index fell 0.4%, the euro rose 0.8% to $0.9776, the British pound rose 2% to $1.1317 and the Japanese yen fell 0.2% to 147.26 per dollar.

🔑 Key events of the day:

Oil also rebounded Thursday for the first time in a week after a US crude report indicated the possibility of a shortage in the market, despite a larger-than-expected 9.9-million-barrel inventory build.

“It’s a super bearish headline, but if you look at the underlying data, it tells a different story,” said Matt Sallee, portfolio manager at Tortoise, referring to this week’s Energy Information Administration report. “The combination of a big distillate draw, another big strategic petroleum reserve draw and then a reversal in exports, I think if you exclude those things, this was probably a more bullish report.”

West Texas Intermediate (WTI) closed above $89 per barrel, after falling in the last three sessions on fears of an economic recession. On the other hand, the international reference Brent for delivery in December was around $94.

Earlier in the session, the International Energy Agency warned that the production cuts agreed earlier this month by the Organization of Petroleum Exporting Countries and its allies could lead to an increase in oil prices.

🍝 For the dinner table debate:

Netflix (NFLX) announced on Thursday it will roll out a service with ads in November, in 12 markets that inclue Brazil and Mexico.

The new basic plan with advertising will cost 18.90 reais ($3.60) per month in Brazil and $6.99 in the United States and will be launched on November 3 at noon. In Mexico, it will cost 99 pesos ($4.95) and will be launched on November 1.

The plan with ads will also be launched in Australia, Canada, France, Germany, Italy, Japan, Korea, Spain and the United Kingdom.

The company had already announced that it intended to launch the low-cost version later this year, in a strategy to seek new revenue as subscriber growth has stagnated in the last two quarters.

Netflix is also testing charging for password sharing in some Latin American countries.

-- Leidys Becerra, a content producer at Bloomberg Línea, and Stephen Kirkland and Emily Graffeo of Bloomberg News, contributed to this report.