Bloomberg Línea — In a pre-seed round, Bolivian startup Koban raised $2.3 million from global funds such as Precursor Ventures, FJ Labs, Goldtruck Holdings, and Class 5 Global, as well as Latin American funds Newtopia, Buentrip Ventures, and iThink VC. 99′s founder Ariel Lambrecht was an angel investor.

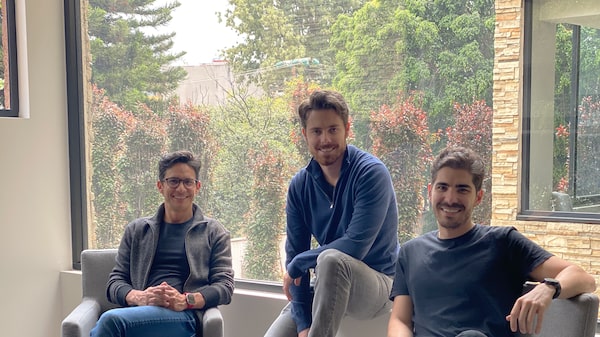

Koban was founded in 2021 by Julio Moreno, Gustavo Añez and Vijay Pratap. The fintech “allows users to perform a variety of financial services, including payments, money transfers, budgeting tools and credit solutions, among other services for consumers and SMEs in the region.”

Gustavo and Julio, from Santa Cruz de la Sierra, Bolivia, played with the idea for years after having experienced first-hand banking deficiencies in the country. As almost any citizen here knows, financial services in Bolivia tend to involve red tape from the moment of simply opening an account, making quick and secure payments, or applying for a loan. Koban aims to offer a solution to the limited access to financial services for the bulk of transactions made mainly in cash.

“This funding will allow the startup to accelerate key hires, increase tech stack and product development, and expedite its marketing and launch strategy in its original market. Koban has already secured a banking partner in Bolivia, where it will launch a suite of financial services later this year, and will soon launch in Ecuador and Paraguay,” spokespersons told Bloomberg Linea.

The team is currently made up of more than 20 people based in Colombia, Mexico, Ecuador, and Bolivia.

The market potential in Bolivia and the entire region they are targeting is more than 70 million people who may have no access to financial services or are underserved by traditional banks. “The Andean region is one of the last untapped frontiers in fintech,” explained Zach Finkelstein, Managing Partner at Class 5. “Only one in five adults has ever accessed an online bank account and less than 10% of people in the region have access to a credit card. There is a huge gap to address,” he said.

Julio, one of the co-founders, who considers himself “a serial entrepreneur and angel investor,” founded Netcomidas, a food delivery app that he later sold to Delivery Hero in a transaction that marked the first exit of a Bolivian startup. He also founded SC Angeles, the largest angel investment group in Bolivia.

Añez was the general manager of BNB Leasing, corporate manager of Tigo Money Bolivia, and part of the financial markets division of the IADB. Until 2021, he was Bolivia’s representative on the World Bank’s executive board.

The Bolivian entrepreneurs partnered with Vijay, who was CTO of Movii, a neobank in Colombia with over 4 million users. Vijay built the technology team and has had previous experience at Mahindra, implementing core banking, card issuance, and solutions across the region.

Koban aims to bring financial inclusion to millions of people living today in Bolivia, Paraguay, Peru, and Ecuador.