Bogotá — Some of Colombia’s most-renowned entrepreneurs, such as Alexander Torrenegra, founder of remote work platform Torre (which raised $10 million in a seed round in 2021); Daniel Bilbao, leader of the identity verification startup Truora (which raised a $15 million Series A in 2022); and Rubén Córdoba, CEO of employment platform HoyTrabajas, which raised a $3.5-million seed round in 2022, recount how their money became trapped by the collapse of Silicon Valley Bank (SVB).

“There were several Latin American companies that were affected and went through a very tough end of the week without knowing what was going to happen. The ecosystem supported each other in a very strong way, with many entrepreneurs, funds and banks helping each other behind the scenes to make sure we were all okay,” Truora’s founder, Colombian Daniel Bilbao, told Bloomberg Línea following the weekend’s wave of panic.

To explain the gravity of the situation, Bilbao on Sunday tweeted a message saying “What people don’t understand: Until recently, no US bank would allow our [Latin America’s] startups to open an account. SVB was the easiest and in many cases the only one. That is why so many startups used it as their only bank. Trust. Nobody else would let us open an account”.

The entrepreneur says that even though the worst part of the crisis seems to be over, there are many questions about the times in which entrepreneurs will recover their money at a time when many of these businesses are already seeing their finances under pressure, mainly smaller startups.

“There was a whole movement of startups talking with their funds, with other startups, with neobanks, trying to take out lines of credit, everything, for those who need to pay payroll,” he said.

Bilbao added that the situation was extremely stressful because the company had several colleagues with their trapped, with extreme cases such as one company, whose name he preferred not to disclose, that only had a budget for six months of payroll and nothing else.

“That could unleash a major crisis, on two levels. On the one hand, in the technology sector. The most affected companies are the smaller ones, because when you are bigger you have many banking relationships. If the US government had not intervened, it would have been very easy to kill off many smaller startups. I am sure that in 10 years there will be the new Google or Facebook and they will say: ‘We almost died four times, one of those was SVB’,” Bilbao added.

The beginning of the collapse

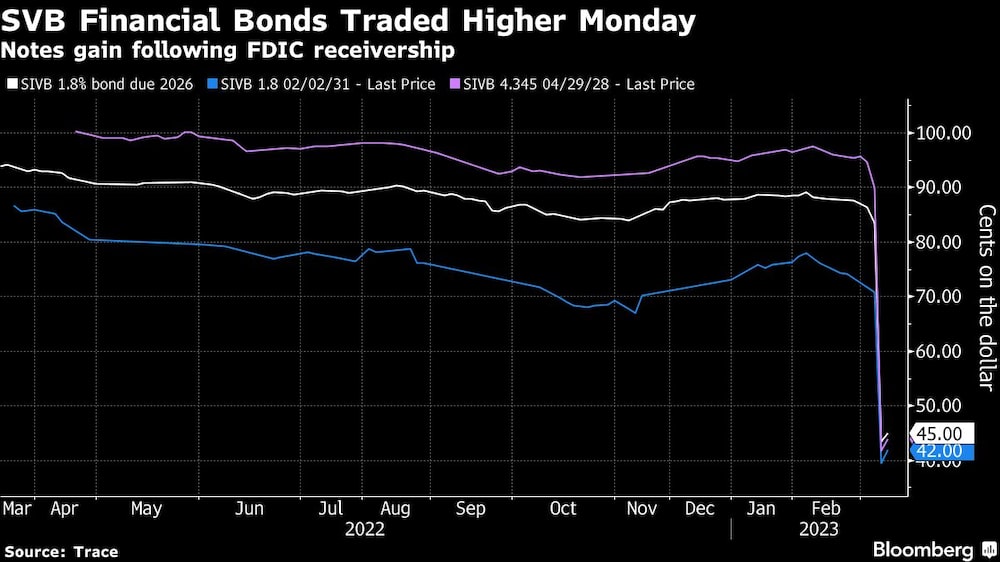

The collapse of SVB generated a crisis at the end of the week with hundreds of entrepreneurs unable to withdraw their funds. SVB’s collapse was the largest failure of a US lender in more than a decade, and sparked warnings of the possibility of a domino effect.

And while some startups heeded the calls and were able to rescue part of their resources, others were left on the ropes and are waiting to recover their capital following the announcement by the US Federal Reserve, which launched a plan to enable customers to take control of their deposits.

In order to prevent the crisis from spreading further, the Fed announced the creation of an emergency instrument to back the banks with a $25 billion guarantee.

“The SVB crisis, which now fortunately has a better outlook, affected not only the United States but also startups and investment funds around the world, and especially in Latin America,” Santiago Rojas, managing director at early-stage Latin American venture capital firm Cube Ventures, told Bloomberg Línea. “Over the weekend, many entrepreneurs and investor friends and allies faced the absolutely devastating situation of losing access to their funds.”

The consequences could have been worse, but the market moved quickly amid the frenzy generated over the weekend, and HSBC Holdings Plc pre-empted further consequences by buying out SVB’s UK unit for £1.

For Rojas, “this news is encouraging and generates confidence in the banking system and will be fundamental in preserving the North American and therefore the global financial system. Today we wake up with banks hit in the stock market with falls in valuation of up to 75%, which is worrying, but leads us to think about a potential consolidation of the industry”.

Entrepreneurs’ experiences

Rubén Córdoba, CEO of Hoy Trabajas, told Bloomberg Línea that since they raised a $3.5 million investment round, the company deposited the funds in SVB.

“It is a pity that one of the largest banks in the world has gone through this situation. It is something that got out of our hands, that did not depend on us, but rather on a series of movements on their part,” he said.

Córdoba said that the uncertainty was total since Thursday and that at first they did not know what to do, and so they talked to their investors.

“Thanks to their support we were able to move quickly, we got advice from people on the tax issue, that if we moved the money from a Cayman Islands account to a US account that was different from the bank’s, what were the implications, and so on, but fortunately the outlook is clearer today. It was a weekend of complete uncertainty”.

The entrepreneur points out that on Thursday they transferred funds to a bank in Colombia with a branch in Panama, but that once SVB was taken over it was not possible for them to use the bank.

“This morning the transactions were rejected; however, with the security and backing of the US Treasury Department we were reassured. Today we were able to enter and complete the transfer. Over the weekend we opened two accounts, one at Morgan Stanley, which allows us to have the same structure, and another at Mercury. As they had been rejected, we had to do the transfers again and in the end we were able to do it. We will have to see what happens in the next few hours,” Córdoba said.

Against the clock

Truora’s Bilbao said they had 90% of the company’s funds in Silicon Valley Bank, but thanks to the fact that they were able to take measures in time, they were able to avoid greater consequences. The fears began on Thursday when César Pino, co-founder of the company, sent him a message alerting him about the sharp fall of Silicon Valley Bank during after-market trading, and they had announced that they were going to issue both equity and debt.

“I got worried at 8 a.m. [on Thursday March 9], I got very stressed because I said, ‘I have all my money in Silicon Valley Bank. Why did I have it there? Because we had just opened a savings account, which gave 4% annual cash and since we had well over $10 million in funding, we put it in the account. And I had the other part of the money in a normal checking account. So I had $12 million outside, plus a million dollars in the subsidiaries,” he said.

Bilbao explained that thanks to his CFO, Mauricio Rojas, they were already in the process of opening an account at JP Morgan, but they had not completed the process and were not eager to do so because there was no way of knowing that a crisis of this magnitude was coming.

“At 8 o’clock in the morning I said, well, that’s dangerous. I called JP Morgan very quickly and said, ‘I need to open the whole account.’ And they said, ‘You’re missing these three things.’ I said, ‘Okay, but can you give me money? Yes, yes, I can receive money’. So, at nine o’clock in the morning I sent $500,000 of the two million I had in the checking account and at 9:30 a.m. I sent another million and a half. By then I had already withdrawn two million. I was in JP Morgan and I had $10 million in the trust. The other thing I did was to withdraw the money from the savings account and put it in the checking account,” he said.

Transfers to rescue capital

Then he began to see how on social networks the discussion around the issue grew, and questions began to spread about how to withdraw the money. Even the investment funds began to alert within the same ecosystem to withdraw the money:

“That’s when panic sets in,” he said.

In the midst of this context, Bilbao tried to make a series of transfers to withdraw the money in several drafts, but these did not go through. “Then I had a wire transfer for $9 million that I was waiting for for almost four hours, almost five hours to get out.”

“There is an issue called the prisoner’s dilemma: it is better for everyone if everyone leaves the money in, but if you don’t get to take it out and you get stuck you don’t know what is going to happen. So by midday it was clear to me that I had to get the resources out because they would be trapped, if not on Thursday, then on Friday, that was my suspicion. I was trying to extrapolate what is happening in Latin America versus the rest of the world,” Bilbao said.

He said that around 3 p.m. he had the opportunity to talk to colleagues such as investors and entrepreneurs in the US, and who were much calmer. But his suspicion was that because in Latin America “there have been more risks of money getting trapped, people were reacting more aggressively and with more apprehension.”

“Around 3 p.m. the $9 million transfer occurred. I had one left. I went from: ‘I’m going to have four months of runway to having a world of runway’. And then I spent the next three hours withdrawing, withdrawing and withdrawing, and trying to help my friends to withdraw their money, how to open accounts. And finally at about 5:30 p.m. my last transfer happened. If it was a little exposed, there was $260,000 left inside SVB, which is $12,000 of insured funds, and so I breathed easier,” he said.

The CEO of Hoy Trabajas added that, after this crisis, things will not be the same in the startup ecosystem, and that for many entrepreneurs the exit of SVB from the market is negative, because it represented the only gateway to the financial system in the US.

“It really saddens us, and we find what is happening regrettable, because in the end, even if it is acquired by another bank or there is another issue, the situation will not be the same. The funds will be in different conditions, as will the startups, they will diversify their financial portfolio and so on because of these things (...) and for the new startups, or those that have already been in the process, let us reflect: one of the things I learned from this is that you have to have your eggs in different baskets. Even if you have your money in a very solid bank, try to have your money in two or three entities that allow you to minimize or distribute the risk”, he concluded.