Bloomberg — Debt markets are signaling a widening gap between emerging market corporate borrowers and their sovereign peers, amid mounting concerns over the ability of companies to refinance at higher rates.

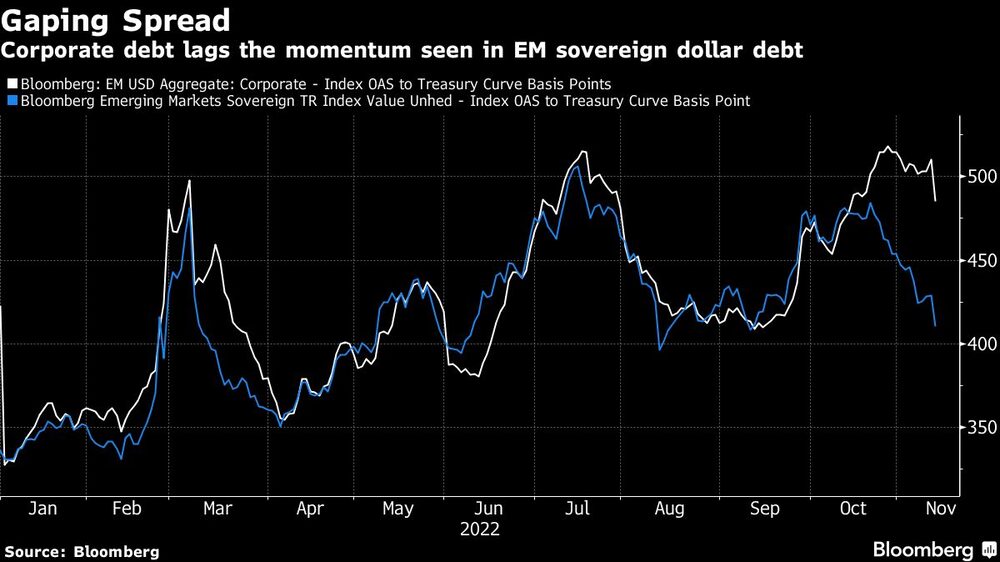

While risk premiums on corporate and sovereign EM debt were similar at the start of 2022, investors are now demanding 72 basis points more from corporate issuers, according to Bloomberg indexes.

The cost of raising new debt is prohibitive for many firms, effectively shutting them out of the market. Those that have managed to place bonds face sky-high costs. Emerging-market borrowers are suffering not only from tightening monetary policy but also increased foreign exchange volatility, often making hard-currency debt payments more expensive for EM companies.

“At the moment, the market is still shut because no one wants to lock in these higher rates,” said Omotunde Lawal, head of emerging-market corporate debt at Barings in London. She noted that tapping international capital markets at such high yields was “the last option” for companies, adding that many firms had sought to refinance when rates were low.

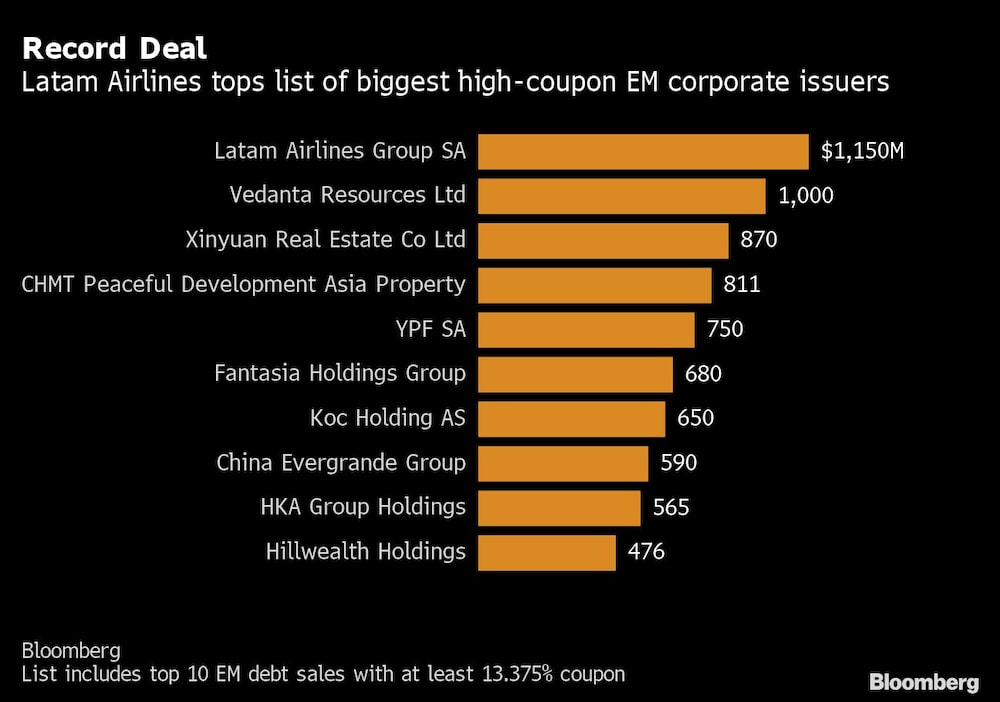

Latam Airlines Group AS (LTM) sold dollar debt last week with a coupon of 13.375%, becoming the first EM company in years to borrow more than $1 billion at such rates.

EM sovereign debt has rallied more than corporate notes on signs of a cooling inflation picture in the US, boosting speculation of a slower pace of Federal Reserve rate hikes. Tighter monetary policy in the US has fueled the dollar’s surge, making debt payments more costly and reducing liquidity available for borrowers in the developing world.

Turkey, Hungary and Poland successfully tapped international debt markets in past weeks, reducing worries over the financing of their foreign-currency debt.

S&P Global Ratings warned in a recent note that corporate defaults in emerging markets, largely attributable to China-based homebuilders, are climbing. That’s as a nearly $250 billion wall of maturity for emerging market debt due next year looms into view, according to data compiled by Bloomberg.

Borrowers are competing for funds that are getting scarcer as $83 billion left emerging-market debt funds this year, according to EPFR Global data, published by Bank of America. EM corporate debt has handed investors a 19% loss so far in 2022 according to data compiled by Bloomberg, compared with a 11% decline for US high-yield debt -- another risky, dollar-denominated asset class.

Issuance by emerging-market companies has amounted to only $15 billion since the start of October, slumping 77% from the same period last year, versus a 29% decline for EM government debt, according to Bloomberg-compiled data.

“We really need to see lower yields before the primary market can come back properly,” said Philip Fielding, co-head of emerging-market debt at Mackay Shields UK LLP, which has $126 billion under management. “Market worries about refinancing risks should decline as more primary deals get printed.”

Elsewhere in credit markets:

Americas

A key measure of US credit risk seesawed on Tuesday after cooler-than-expected producer prices countered a report that missiles crossed into Poland.

- Banks led by Bank of America Corp. kicked off a $1.75 billion leveraged loan sale to refinance debt that helped fund the buyout of TV ratings business Nielsen Holdings Plc

- Tobacco giant Philip Morris built a $31bn order book for its $6bn deal to support an acquisition while two issuers priced new debt rich to their respective credit curves, as the US high-grade funding landscape continues to improve

- A unit of United Rentals Inc. sold $1.5 billion of bonds Tuesday to help finance its purchase of Ahern Rentals Inc.

EMEA

There were six issuers across six tranches in Europe’s publicly syndicated debt market on Wednesday morning, with minimum issuance volume expected to be at €2.57 billion ($2.68 billion) equivalent.

- More companies in England and Wales were forced to close by creditors in October than in any month since Covid-19 starting spreading, showing that UK creditors are back to adopting pre-pandemic practices in retrieving unpaid debt

- Soaring energy bills drove UK inflation even higher than expected to a 41-year high in October, adding to pressure on the Bank of England to act

- The looming wall of maturing bonds facing Sweden’s leveraged property sector continues to prompt negative rating actions from the agencies assessing the likelihood of defaults

- Telecom Italia’s long-term issuer default rating was downgraded by Fitch to BB- from BB and outlook remains stable

- European leveraged-loan and high-yield par volume defaults are set to rise “materially” in 2023 and 2024, according to Nov. 15 report from Fitch Ratings

Asia

Yields are soaring in China’s local credit market, after having been sanguine throughout the property sector’s debt crisis.

- South Korean insurer Hanwha Life Insurance Co. will buy back its hybrid securities at the first opportunity next year, an assurance for investors rattled by the decision of a competitor to skip a payment, which triggered a selloff in perpetual bonds across Asia

- Rakuten Group Inc. is marketing a $500 million dollar bond to bolster the Japanese internet firm’s struggling mobile unit, in a test of demand for a rare junk debt offering from the country and a borrower under financial strains

- A consortium led by Japan Industrial Partners Inc. that is seeking to acquire Toshiba Corp. is in talks with about 20 potential co-investors to back its bid for the venerable industrial group, according to people familiar with the matter

- Korea Gas sent a request for proposals to hire arrangers for a possible sale of ~1t won hybrid bonds next month, according to a spokesperson.

Read more on Bloomberg.com