Mexico City — Spanish energy company Repsol plans to develop two deepwater fields in Mexico during 2024 and begin crude oil production in 2026, Sergio Limardo, CEO of Repsol Exploración México, said in an interview with Bloomberg Línea.

The Polok and Chinwol offshore fields, discovered in May, will provide an estimated production of 50,000 to 60,000 barrels per day of 21 degree API medium crude oil, Limardo said, and the company plans to submit a development plan for the fields to Mexico’s Hydrocarbons Commission (CNH) in mid-2024.

“First production from Polok and Chinwol should be coming by the end of 2026″, he said during a conversation at Repsol’s offices in Mexico City.

The private sector currently produces around 105,000 barrels of oil per day in Mexico. Repsol’s production would be equivalent to almost 60% of the current total.

Limardo said that Block 29, with an extension of 3,253 square kilometers, is so large that Repsol is already analyzing another discovery prospect 50 kilometers away from Polok and Chinwol that, if successful, would require its own infrastructure.

“These are estimates, we also don’t expect that the discoveries we are seeing are going to be 120,000 barrels. But we are going to be more or less in the range,” he said.

The executive added that a new field in the block would not necessarily increase production, which is limited by the available infrastructure, a floating production, storage and offloading tanker (FPSO) in the case of Polok and Chinwol.

“If your infrastructure doesn’t allow you to increase production, what you can do is lengthen it.”

Deepwater drilling

The deepwater region in the Gulf of Mexico, from beyond 500 meters, is a ‘final frontier’ for the country’s oil industry due to its high costs and technical complexity. Although state oil company Pemex discovered the Trión offshore field in 2012, it decided to share the exploratory risk and forge an alliance with Australian company BHP -now part of Woodside Energy-, which took a 60% share of the field.

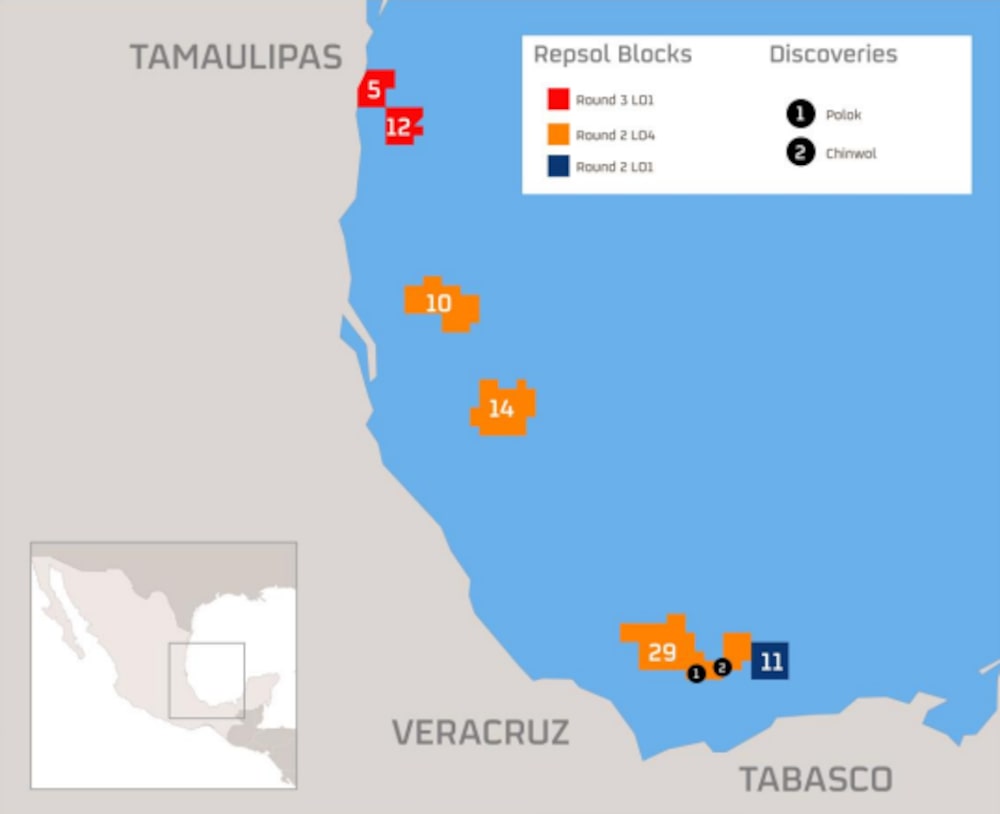

Repsol won five contracts in Mexico’s oil and gas auctions, among them block 29 in deep waters with its partners PC Carigali -a subsidiary of Petronas-, PTTEP Mexico and Wintershall Dea in 2018, and in which it has invested $765 million for the drilling of exploratory wells, production tests, taxes, technology transfers and sustainability projects.

Four years later, the company returned five of the six blocks to the Mexican state to concentrate on block 29 where it found oil with commercial potential.

Repsol has yet to drill an exploratory well that will require $60 to $80 million of investment.

However, inflation has increased the costs related to drilling services, in addition to the higher price of oil, Limardo said.

“This has caused us to fall a little behind schedule,” he said.

Moving toward more sustainable operations

Limardo said that Repsol is analyzing the use of green technologies that reduce its carbon footprint and offset emissions from oil and gas production, such as solar or wind electrification of the production tanker in the block, or a system that limits emissions during production, although subject to economic feasibility.

“Those kinds of technologies can be applied in projects that are just starting out. It is much more difficult to do it in a project that has been producing for 20 years,” he added.

The company is also working on mangrove restoration in Tabasco with the Universidad Juárez, as well as developing a project with carbon credits to offset its emissions during the life of the offshore fields.

More oil rounds

In view of the suspension of more auctions in Mexico, after the arrival of Andrés Manuel López Obrador to the presidency, Limardo said Repsol is interested in participating in more oil rounds because the potential of the Gulf of Mexico is “very high” and has not been explored enough, not only in deep waters but also in shallow waters.

“We believe that Mexico is an interesting country to invest in, and where we have to continue our presence,” he added.