Bloomberg — Renat Heuberger gathered his co-founders on a glacier in the Swiss Alps for a celebration. The half-dozen men behind South Pole, the world’s leading seller of carbon offsets, raised their beers around a crackling fire: Business was booming and the Zurich firm’s valuation was hurtling toward $1 billion, making it one of the first “carbon unicorns.”

But the claims underpinning South Pole’s success have been losing ground like the ice underfoot that day two summers ago. The company’s biggest moneymaker is a mega-project in Zimbabwe called Kariba, which South Pole claimed has prevented the annihilation of a forest nearly the size of Puerto Rico. That’s South Pole’s business model: help finance projects that can credibly counteract rising levels of greenhouse gas, such as by stopping deforestation, and then sell the resulting credit to corporate clients who want to compensate for their own planet-warming pollution.

Yet according to several outside experts and South Pole’s own analysis, the firm and its partner ended up vastly overestimating the extent of the preservation by Kariba. As a result, Gucci, Nestle, McKinsey and other South Pole clients have — unwittingly — overstated their own progress in combating climate change, because the Kariba credits they bought haven’t generated enough real atmospheric benefit. (South Pole says the credits are legitimate and will still benefit the climate.)

Recent financial details released by South Pole make these flawed credits even more troubling to some customers. Most of Kariba’s €100 million in proceeds have gone to South Pole and its project partner, a company called Carbon Green Investments, not — as both companies previously indicated in interviews and public blog posts — to people in the rural communities who do the work of fighting deforestation.

Some of South Pole’s biggest customers have started to balk. Officials at Barclays, L’Oreal and McKinsey told Bloomberg Green they’ve either used up their Kariba credits or had no plans to buy more. Dutch energy company Greenchoice, which acquired more than 4 million Kariba credits, said it was “unpleasantly surprised” and would launch an investigation before determining its next steps. Takeda Pharmaceutical Company, which used 75,000 Kariba credits in December to help reach climate targets, said it’s “pausing any future investments with South Pole.”

South Pole says that the complex forces driving deforestation have changed in the decade since it helped launch the project, but that all Kariba credits are still credible and the project has followed industry standards. South Pole said it bought millions of Kariba credits to support the project during lean times, then their value later soared.

“We are genuinely proud of the project, which has protected over 750,000 hectares of forest and benefited many thousands of people in a rural area in Zimbabwe,” South Pole said in a statement.

The uncertainty about South Pole’s flagship project could influence how legions of companies try to slash their emissions. Purchases of carbon credits quadrupled in 2021 to $2 billion, according to Ecosystem Marketplace. But persistent questions about their benefits have damaged their reputation as a legitimate climate solution. Due mostly to this “growing criticism of carbon offsets,” corporations used 4% fewer credits in 2022, according to researchers at BloombergNEF.

“No one who buys a five-kilo pack of potatoes at the supermarket wants to end up only having one kilo,” said Jürg Füssler, a carbon market veteran who heads up environmental work at INFRAS, a research and consulting firm in Zurich, speaking broadly about the industry. “That’s what’s happening now. The basic market confidence is shattered.”

Even airlines, among the biggest buyers of offsets, are seeking alternatives. Delta Air Lines, which has spent hundreds of millions of dollars on carbon credits, some from Kariba, has joined with JetBlue, EasyJet and others to prioritize other emission-cutting methods instead. Other big buyers like Volkswagen are no longer relying on middlemen like South Pole and instead plan to develop their own carbon projects, a step they hope will avoid allegations of greenwashing.

The Kariba project is large enough to potentially accelerate the downward spiral. The Zimbabwean conservation effort is the second-most popular in the voluntary carbon market, according to AlliedOffsets, which tracks carbon transactions. By one measure, there are around 7,000 projects in the market. Companies have bought 23 million credits from Kariba, enough to offset more than half of Switzerland’s annual emissions.

“When a highly-marketed and well-known project is revealed not to be delivering the claimed impacts, there’s a risk the entire reputation of carbon markets will be destroyed,” said Allister Furey, head of Sylvera, a London-based firm that rates the quality of carbon projects and which gave poor marks to Kariba.

South Pole’s reputation carries major implications for the broader carbon market. The company has a hand in nearly 1,000 carbon projects around the world. As part of this investigation, Bloomberg Green reporters visited several projects backed by South Pole, including a Mexican teak plantation that appeared to fall short of its advertised climate impact.

South Pole officials said the teak project met industry standards, and they say the company has long delivered real climate benefits, proof that market mechanisms can be used to address climate change. “High quality and a consistent drive to innovate have been at the very core of our company,” Heuberger, the chief executive, said in an email.

To some experts, however, South Pole’s real edge has been its business savvy. “Since the voluntary carbon market took off in 2018, they’ve been touching the pot of gold,” said Axel Michaelowa, a founder of Perspectives, a climate consulting company that has collaborated with South Pole. “They’ve not really been fighting for a high-integrity market. They’ve been trying to capture benefits wherever they can.”

“What bullshit is this?” Heuberger wondered when he first learned about carbon offsetting roughly two decades ago. The idea of paying one party to cut emissions, then letting someone else take credit for the environmental gains smacked of buying off one’s climate sins, he recalled in an interview last summer over a bowl of tofu curry near South Pole’s Zurich headquarters.

Then he found himself with a personal dilemma: He was flying to a conference in Costa Rica, a trip which, he calculated, would make him responsible for a few tons of CO2 emissions. Instead of foregoing the trip, he organized an effort to swap solar panels for diesel burners at the event’s location, an improvement designed to make up for the emissions generated by Heuberger and others flying there. Conference attendees paid $25 per ton of emissions, allowing Heuberger to raise several thousand dollars.

He was hooked. “This the most powerful climate finance instrument that was ever invented,” said the 46-year-old, who sports a close-cropped beard of copper, silver and white, and likes to hike and kitesurf.

Shortly after graduate school, Heuberger and a group of college friends started a company to sell carbon credits at scale: South Pole, a name they chose partly because Antarctic ice melt is a vivid symbol for the need to act on climate change, and because their projects would aim to help poorer communities in the Global South. Heuberger and four other co-founders each put in 20,000 Swiss francs (about $21,000). Heuberger borrowed his contribution from his parents.

South Pole’s fortunes followed the broader carbon market. When they first started 17 years ago, climate action seemed inevitable. An Inconvenient Truth won two Oscars. The United Nations Intergovernmental Panel on Climate Change was awarded the Nobel Peace Prize.

After that initial rush, carbon credits’ value fell to nearly zero. The carbon-trading system established by the Kyoto Protocol collapsed, and the voluntary carbon market, where South Pole operates, barely survived. Many competitors shut their doors.

During the lean times, South Pole began helping corporate clients with a range of climate needs, like measuring supply chain emissions and guiding them on ways to reduce their carbon footprints. Often these arrangements culminate in a sizable sale of carbon credits. (Bloomberg LP, the parent of Bloomberg Green, partners with South Pole to purchase carbon credits to offset global travel emissions.)

Since the market rebound began five years ago, this full-service approach has proven extremely lucrative. South Pole has more than 1,200 employees on six continents and investments from Salesforce, the Singapore government and Liechtenstein’s royal family. Revenues jumped more than six-fold in the last three years to an estimated €232 million, the firm says. Heuberger’s personal stake, slightly less than 10%, is worth nearly €100 million.

Heuberger says South Pole thrived because it built a record of innovation. The company, for instance, hatched early carbon projects that cut deforestation in rural Africa by delivering chlorine dispensers, eliminating the need to chop down trees for firewood to boil their water. Heuberger also points to a recent carbon deal they helped orchestrate, where the Swiss government will fund the adoption of electric vehicles in Thailand.

South Pole employees — nicknamed “penguins” after the inhabitants of the geographic South Pole — are sometimes skeptical. They grilled Heuberger at an all-hands meeting after French oil major TotalEnergies SE claimed in 2020 that a shipment of its natural gas was “carbon neutral” because it had purchased Kariba credits. Heuberger agreed: “It’s such obvious nonsense” to claim fossil-fuel emissions are counterbalanced by carbon offsets, he told Bloomberg Green at the time. (At the time, Total said it conducts due diligence on offset projects.)

When it later emerged that South Pole might advise Saudi Arabia on its net-zero goal, penguins challenged Heuberger on the morality of working with the country, given its human rights record and unwavering commitment to fossil fuels. Saudi Arabia can’t be ignored, Heuberger responded: They are a major contributor to global emissions. Not long after, he flew to Riyadh to speak at Crown Prince Mohammed bin Salman’s inaugural showcase of his country’s green initiatives.

South Pole has also failed to avoid a problem that’s pervasive in the carbon market. Offset projects often fall short on " additionality” — the requirement that carbon payments are necessary to drive climate-friendly activity. On a recent visit to the teak plantation near the ruined Mayan city of Palenque in southern Mexico, the thick jungle slowly gives way to cow pastures. At the edge of one field jut endless rows of skinny teak trees, planted in 2013 by forestry firm Agropecuaria Santa Genoveva.

Five years later, with South Pole’s help, Santa Genoveva started a carbon project to sell credits for the CO2 absorbed by these trees. One of the largest buyers is San Francisco real estate firm Prologis. It purchased about 100,000 credits early last year to help declare a sprawling facility outside Paris “carbon neutral.”

But the teak plantation seems to fail the “additionality” test: It would have existed with or without carbon payments. Santa Genoveva’s production director Victor Fernandez told Bloomberg Green that carbon offsets didn’t alter the company’s business plan or encourage it to plant more trees. “We’ve kept the very same plan we’ve had since the beginning,” he said in an interview. “It’s simply an extra benefit.”

Three companies that rate the quality of carbon projects raised red flags about the project. Sylvera, for instance, gave the teak project its lowest possible score, indicating “a very high risk that the claims of a project are inaccurate.”

South Pole disagrees with the project’s critics, saying the promise of carbon payments helped Santa Genoveva develop more plantations than it otherwise would. It also said the project adhered to market standards. This is an increasingly common response in an industry trying to deflect mounting criticisms of useless offsets.

A bigger problem, though, was quietly simmering some 14,000 kilometers away. As early as 2010, South Pole and Carbon Green Investments (CGI) began work on a carbon project on nearly 2 million acres of Zimbabwean forest.

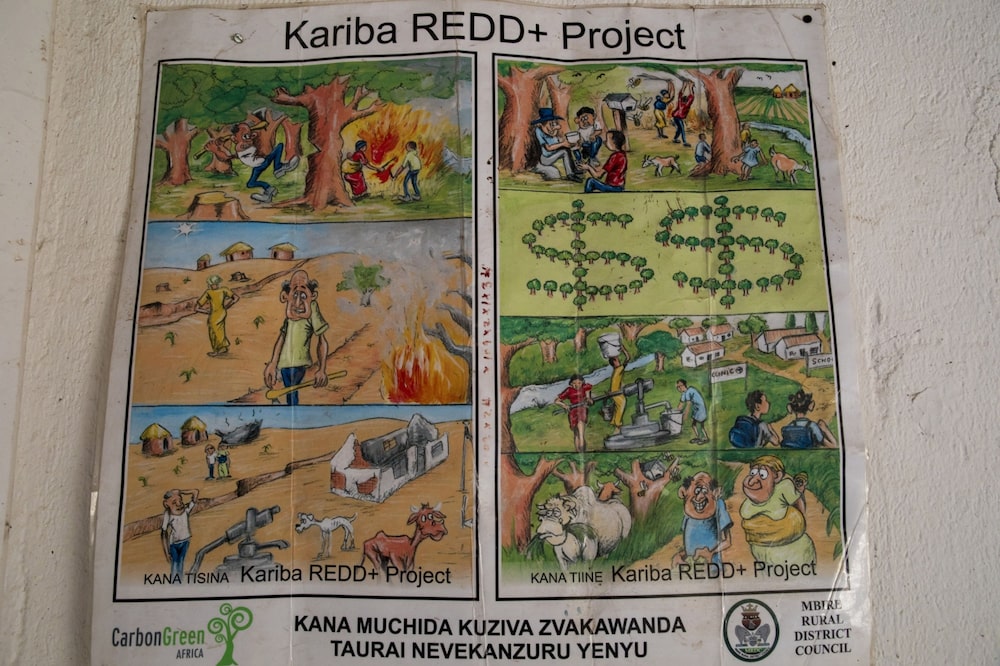

This vast expanse of trees was facing obliteration, according to the project documents. Carbon funds could save them, in theory, preventing deforestation by teaching local villagers sustainable farming techniques and training them in forest-friendly jobs like beekeeping.

By almost all accounts, the money generated by the Kariba project has helped. But the original prediction of mass deforestation was wildly overstated. The companies generated — and sold — credits for saving trees that, it turns out, weren’t under threat.

How exaggerated did the initial claims turn out to be? In November, Elias Ayrey, chief scientist at carbon ratings firm Renoster, estimated Kariba claimed 30-times more carbon credits than it deserved. Sylvera and Calyx Global, another ratings firm, put the factor at five to eight.

South Pole confirms the volume of credits issued thus far has eclipsed the project’s climate benefits. Nonetheless, the company adamantly denies that any of the Kariba credits are in any way illegitimate. “Kariba has never over credited,” Heuberger insisted in an email.

To explain this apparent contradiction, South Pole again points to industry standards. In this case, Kariba met the rules set up by the non-profit group Verra, which oversees the world’s most popular registry of carbon projects. Under Verra’s rules, if the original estimates are deemed to have been too aggressive, the project can make up for this by not issuing legitimate credits in the future. South Pole says that companies buying Kariba credits weren’t mistaken in claiming to have slashed their emissions — it’s just that the CO2 might not be pulled from the atmosphere until years down the line.

Best-case scenario, it’s an expensive mistake. Sylvera estimates that South Pole and CGI would have to operate Kariba for another 25 years to fulfill the credits it’s already generated. Funding the project costs at least $60,000 a month, and it’s unclear whether South Pole and CGI would be willing to sustain it for such a long period. (South Pole said it can’t discuss specifics until the revised deforestation rate is calculated and audited. CGI founder Steve Wentzel said he’s not a technical expert and deferred questions about crediting to South Pole.)

Kariba’s finances have also sparked concerns among customers. South Pole and CGI both initially told Bloomberg Green that South Pole keeps 25% of the sales of Kariba credits in return for its technical and marketing work. South Pole then passes along the rest to Guernsey-based CGI, which takes 30% of the remaining amount. The rest (52.5% of the original proceeds) is supposed to be allocated by CGI to the local communities and governments through a precise formula.

South Pole does, in fact, have a contract to sell some credits for a 25% fee. But, in most cases, South Pole has directly bought the credits from CGI before reselling them to its corporate clients at much higher margins, as first reported by Dutch news outlet Follow the Money. After journalists including Bloomberg Green pressed South Pole for more details, the company published new numbers showing that it had taken closer to 42% of the Kariba project proceeds.

South Pole told Bloomberg Green it bought those credits between 2015 and 2019 when it “stepped in as an investor of last resort” to keep the project afloat during the market’s most dismal years. But South Pole made its largest direct purchase of 7.9 million Kariba credits in 2021 — a fact the company reported in a later blog post. This was long after the market recovered, a strategic move to solidify its relationship with CGI and fend off a competitor, according to two people familiar with the transaction who asked not to be identified discussing internal business. When asked why they initially left out key information about the timing of its largest direct purchase, South Pole officials said they’d been “as transparent as possible in our communication.”

It’s become a familiar predicament in the offsets industry: A large project that follows the rules is shown to deliver far fewer benefits than advertised. Sellers like South Pole have yet to take the kinds of bold but expensive actions — canceling unsold credits; refunding customers — which could rebuild confidence in carbon offsetting.

For Kyle Harrison, BloombergNEF’s head of sustainability research, reluctance to push for higher quality is mind-boggling. He says carbon offsets can become an important tool to slow climate change, with the market potentially soaring to half-trillion dollars per year by 2050. But it will languish without big improvements. “The market today is digging its own grave,” he said.

Back at South Pole’s sparsely decorated headquarters in Zurich, company officials paint a much different picture. Climate change can’t be slowed without massive amounts of private capital to help protect forests and slash emissions. Carbon offsets are the best conduit for this case, they argue, and criticizing them will only hinder this urgent task. “We have no more time,” Heuberger said. “This is the last eight or nine years where we can make a difference.”

Read more on Bloomberg.com