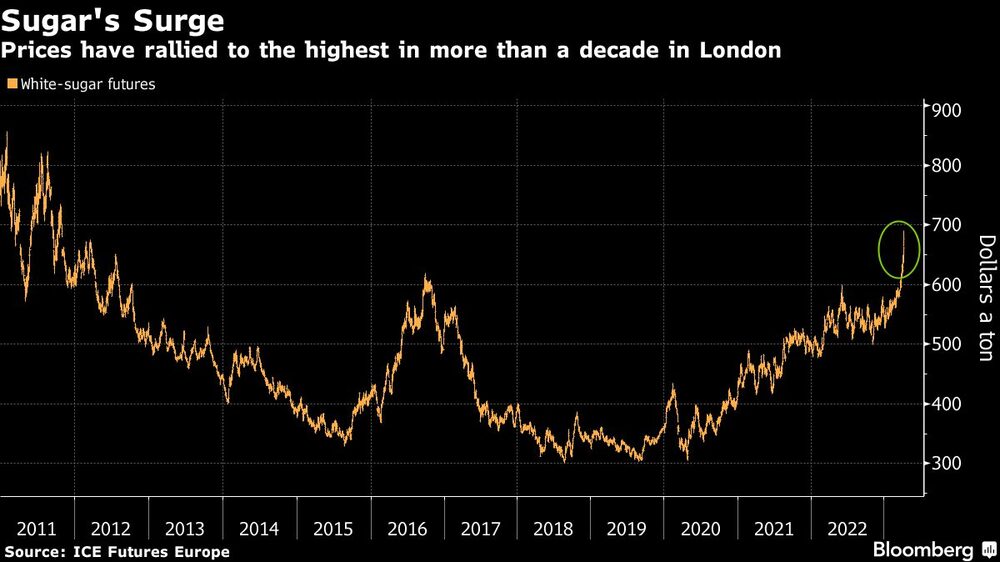

Bloomberg — Sugar extended its surge to the highest in more than a decade in London on mounting worries about tight global supplies, threatening to maintain pressure on global food inflation.

White-sugar futures jumped as much 4.3% on Tuesday, touching the highest since 2011. Prices of the sweetener used in everything from soft drinks to chocolate have jumped on prospects for limited exports out of key shipper India and lackluster supplies from other countries including Pakistan and Thailand.

There have also been concerns that oil’s recent push higher may spur Brazilian and Indian mills to divert more cane to making ethanol. Millers in those countries can decide whether to make more sugar or biofuel, depending on what’s more attractive.

“The sugar market is really tight,” said Francois Thaury, an analyst at Paris-based adviser Agritel. “We have had downward revisions of production in major countries.”

Higher sugar prices are adding to the expense of making products like confectionery and baked goods at a time when energy, fuel and labor costs have also risen. For example, the rally has already worsened the impact of inflation in the UK, with shoppers paying more for things like sweets and soft drinks.

Higher retail prices of sugar in India is also adding to bets that the government won’t permit additional exports this season, pressuring the market even further, Thaury said.

A large crop in Brazil for the 2023-23 season could help ease the market tightness. Still, a lack of deliverable sugar ahead of the May white-sugar contract’s expiry on Friday, combined with funds buying, is driving prices higher, according to Claudiu Covrig of Covrig Analytics.

“Brazilian volumes are deeply needed, but they are not there yet,” Covrig said. “Funds might soon become the market pilots, while the rest will remain just passengers.”

White sugar was up 2.7% at $679.50 a ton in London, advancing for a fourth session. Raw sugar gained 2.2% in New York, and touched the highest since 2016.

In other soft commodities, arabica coffee rose 1% and cotton edged higher in New York.

Read more on Bloomberg.com