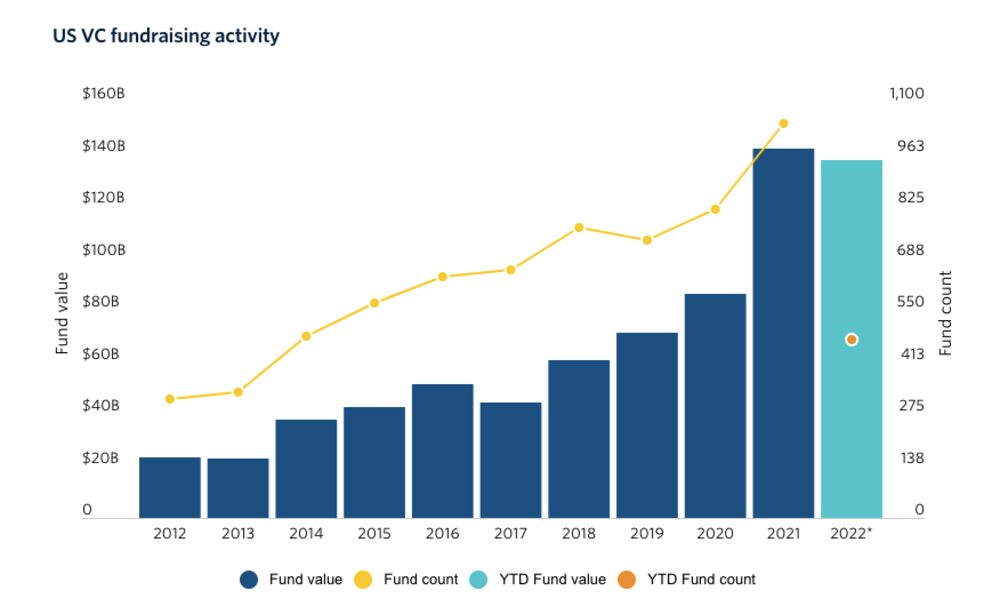

Bloomberg Línea — Even with the market turnaround, there is still optimism on behalf of the venture capital firms that are managing to raise money with new funds. According to Pitchbook, in the United States, 2022 has been the best year for fundraising for the funds, with $137 billion so far. In all of 2021, $142 billion was raised by venture capital funds.

At Kaszek, 90% of LPs are from outside Latin America: they are in the United States, Europe, or Asia. “They’ve lived through that cycle and they’re still thrilled with Latin America. There will be a lot of capital going to managers,” said Kaszek partner Santiago Fossatti during an ABVCAP (Brazilian Private Equity and Venture Capital Association) event last week.

For him, the conversation with LPs (Limited Partners, family offices, and pension funds that have their assets managed by VC firms) has not changed with a more restricted market for risky assets. “They are very calm, they have been working with us for five, 10 years”, he said.

He says Brazilian LPs are in a calm mode now because they understand the startups they invest in. “People they know are becoming clients, they understand what these companies do,” he said.

For Eric Acher, founding partner at Monashees, conversations with Limited Partners are ongoing and Monashees investors understand the cycles of investing for the long term and that a potential correction would come.

“We have had liquidity returned several times compared to the first fund, which helps a lot in that conversation,” he told during the event. 70% of LPs who hold their assets in Monashees are global investors.

Acher recalls that this is not the first correction the Venture Capital industry is experiencing, but it is the first time this has happened after VC has spread to emerging markets in the last 10 or 15 years. And he says LPs know how to recognize that cycle.

“The global funds are all raised, so you have a lot of dry powder (money to invest in opportunities),” Edson Rigonatti, co-founder of Astella Investimentos, said in an interview with Bloomberg Línea.

In recent days, Astella announced it had raised $150 million in a new fund to invest in early-stage.

“We are now coming in at 2017 prices, with product quality of 2023. So we think this will be the best vintage to invest in because you are picking up a great entry point,” Rigonatti said.

For the Astella partner, a significant amount of companies will go through a review process with the possibility of capturing a stable round - at the same valuation - or a down round (with a valuation below the previous round.

L’Attitude Ventures is another firm that just closed a $100 million fund to invest in Latino entrepreneurs in the US. Maya Capital and Vine Ventures also raised funds to invest in the region.

The Menlo Park-based VC firm Lightspeed Ventures has recently announced a $7 billion fund, in which part of the amount would go to Latin America, as reported by fintech’s Trace Finance blog. “We are excited to increase our investment in Latin America going forward,” said Mercedes Bent, partner at Lightspeed.

Trace Finance has a business model similar to Silicon Valley Bank, allowing startups in LatAm to receive foreign funds.

“VC funds are poised to break a record this year. There’s a lot of dry powder in the market, VCs will keep investing and great founders will get funded,” said Bernardo Brites, Trace Finance’s CEO, in a statement to Bloomberg Línea. “The real question that founders and VCs are trying to answer is at which terms.”

Chris Yeh, a Silicon Valley investor and mentor, said in an interview during his time in São Paulo last week that he feels more “optimistic”.

“In the US, inflation is lower than it was, although it’s still high. It looks like the government is taking the right measures to reduce the money supply with interest rates. And that makes things better for the world of startups because we need certainty, we need capable people to invest in the markets,” he stated.

However, Yeh acknowledges that there will still be rocks in the road because of an unstable geopolitical situation. “We don’t know what’s going to happen in Europe, Asia, all those things have the potential to make investors more pessimistic. But assuming nothing crazy happens, I think we will start to see a recovery towards the end of this year or the end of next year. But we probably won’t feel like there’s been a recovery until the middle of 2023″.

According to information from the TTR (Transactional Track Record) for venture capital investments in the second quarter of 2022, there was a 33.97% drop in the total value transacted in dollars in Latin America compared to the same period last year. Even so, the number of investments grew by 9.09%.

There were 278 domestic transactions and 250 from foreign funds.

The most active investors in Latin America in the second quarter were Kaszek, Canary, SoftBank, Global Founders Capital, DOMO Invest, Tiger Global Management, Y Combinator, and Platanus Ventures, according to TTR.

Taking into account exits, i.e. divestments (by IPO or sale of the company), Astella tops the list in Latin America in the second quarter, according to TTR data.

In Brazil, investments from Private Equity funds, which are usually allocated to more mature companies, reached R$ 11.3 billion, an increase of 2.725% in the second quarter of this year compared to the same period last year. The volume for Venture Capital was R$ 5.2 billion, a drop of 62% in comparison to the second quarter of 2021. The data are from a quarterly survey conducted by KPMG and the Brazilian Association of Private Equity and Venture Capital (ABVCAP).

“Venture Capital is characterized by being a more acyclical asset class. LPs know that results come in a crop. Despite, or perhaps because of, this correction, vintages after corrections are very good and valuations are more realistic,” Acher said.

“I don’t think ‘hype’ is synonymous with a bubble. It was predictable that there would be a correction at some point,” said the Monashees partner. For him, adjustments in valuations have more to do with the financial cycle than the timing of technology.

“In 2000 it was the end of a tech cycle. Not now, it has more to do with interest rates,” he said. However, Acher acknowledges that investments in companies that call themselves “tech-enabled”, i.e. that are not tech-native but use technology to leverage services, as is the case with WeWork, for example, have been “overdone”.

For Acher, the great achievement of a boom cycle was to have put Latin America on the venture capital map. “The United States has had 14 years of a bull market. Brazil has had four or five. The party starts late and ends early here, but it was enough to put us on the map and establish the industry,” he stated.

Read Also:

VCs Advise Startups Running Out of Cash: Try in the M&A Markets