São Paulo — Leia em português

Fabien Mendez, who founded Brazilian logistics unicorn Loggi in 2013, is stepping down as CEO at a time when the company is laying off 15%, around 540 employees, of its roughly 3,600-strong team.

Mendez, who told Bloomberg Línea in June that the decision to make cuts stemmed from the company’s cash situation, will remain at the startup in the role of executive chairman. The founder of the Brazilian e-commerce company Dafiti, Thibaud Lecuyer, and who has been CFO at Loggi since October 2019, will be the new CEO of the logtech.

And Carlos Araujo, who until now led the financial planning and analytics area, will be Loggi’s new CFO.

Loggi said in a press statement that the staff reduction is part of a set of actions to “increase operational efficiency” taken in the last six months as the company aims to adapt to the new global scenario and ensure the sustainability of the business.

Loggi raised a $212 million Series F in March last year. Monashees, SoftBank, and GGV are among the startup’s key investors.

“The company thanks the dedication of the people who were disconnected today and reinforces the availability of a benefits package that includes cost assistance for hiring, a health plan for the holder and dependents, psychological assistance, and support in the process of professional relocation,” the company said in a statement.

“Loggi also reiterates its purpose to transform businesses by connecting Brazil with a simple and innovative delivery experience.”

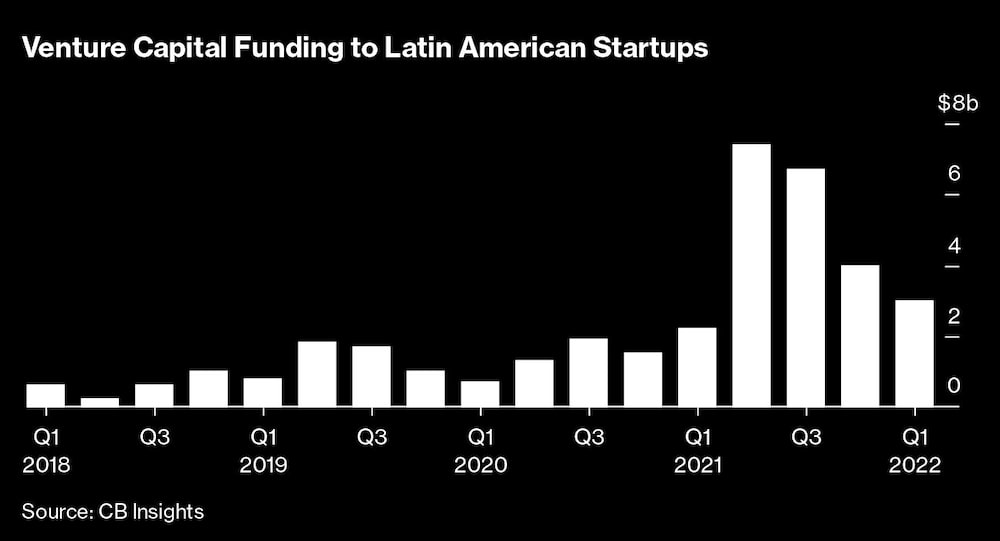

While last year Latin American startups raised a record $16.3 billion, now, amid greater risk aversion, investors have become warier of investing in startups. According to Pitchbook, $2.04 billion was invested in the region in the second-quarter of 2022, a 71% drop from the quarterly high of $7.12 billion in the third quarter of 2021.

Still, some think the bonanza for Latin American startups will return soon.

“I don’t think this will be as deep as the dotcom crisis,” Chris Yeh, a Silicon Valley investor and mentor, said in an interview in São Paulo last week.

“These businesses have real products, real revenue, people who want the products. It’s very different from the dotcom crisis when you had companies where unit economics made no sense at all,” Yeh said.

“But I don’t think it’s going to come back as quickly as in 2008 and 2009 because we’re past the 2008 and 2009 timeframe,″ he said.

Those who are already in the late-stage, pre-IPO, end up suffering more from the lack of third-party money. This is the case with Loggi. In June, Mendez told Bloomberg Línea that he did not see a scenario for IPO in the next two years.

Ebanx and Hotmart have also postponed their plans to go public this year, people familiar with the matter told Bloomberg News.

Chilean benefits unicorn Betterfly arrived in Brazil in October last year. In February, the company received a $125 million boost in a Series C. But last week, the company laid off approximately 30 employees in Brazil, according to people familiar with the matter. The cuts were only in Brazil.

Through a press statement, Betterfly Brasil said that it started a process of restructuring its teams in a “strategic redefinition to take its product - which combines protection, prevention and purpose - to millions of families in the country and, also, to adapt to new offers it will bring to the market”.

“Since the moment it decided to expand its operations, Brazil has been a pillar within the global strategy to reach the goal of protecting 100 million people by 2025. The changes seek to strengthen the structure for the efficiency and specialization of the first social unicorn of Latin America,” said Betterfly.

Sol De Cabo, VP of People & Culture at Betterfly, said in a statement that the company is moving towards a more efficient and agile operation with the restructuring. “At Betterfly, people are at the heart of what we do and, in this process, respect and human dignity is essential to us, taking care of people not only at the beginning of their work experience with us, but also at the end of their life. experience as a Betterflyer,” he said.

SoftBank, through the SoftBank Latin America Fund, headed by former executive Marcelo Claure in 2019, was a key player in the growth of venture capital and unicorns in Latin America. But now, the Japanese conglomerate has participated in venture capital deals in Latin America worth $1.57 billion in the first half of 2022, down from $4.31 billion in the previous two quarters, according to Pitchbook. SoftBank said it would not comment on the report.

Pitchbook says the decline in investment in Latin America is more pronounced than in more established regions such as the US and Europe.

-- Updated to add Betterfly statement

Also Read: