Bloomberg — The Uruguayan peso’s impressive rally this year, which won it a stop among the world’s top-performing currencies, may be nearing an end.

The Uruguayan economy is one of many that would shift away from sharp rate hikes in 2023 as inflation ebbs, in a move that traders say would lead to a weaker peso. Even the head of the central bank foresees the end of a rally.

Uruguay’s central bank president, Diego Labat, said in a radio interview this month that models and market readings indicate that a turnaround would be expected relatively soon.

Such a turnaround would mark the end of the peso’s epic rally, which made it one of the few global currencies to advance against the dollar in 2022.

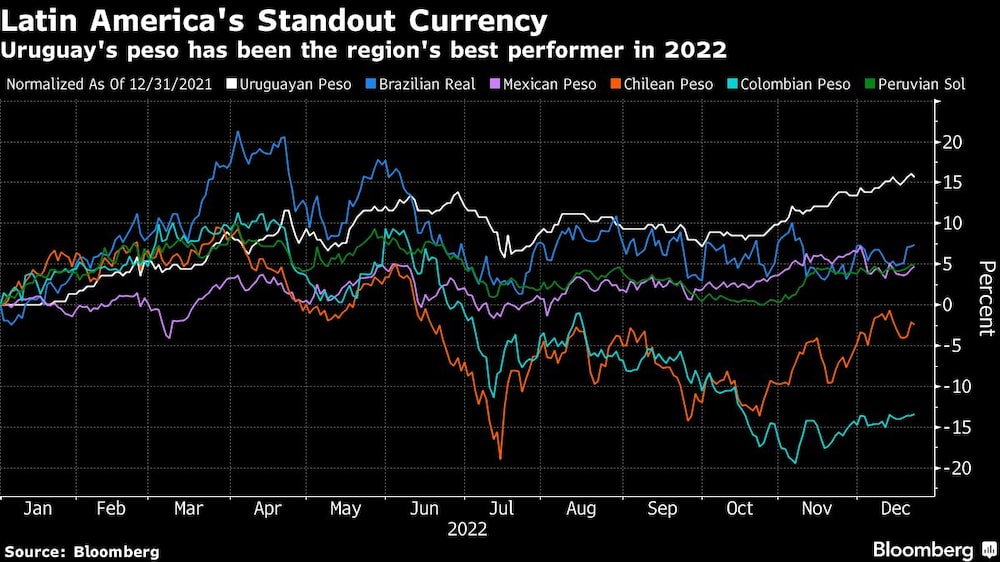

A series of interest rate hikes, booming exports and foreign investment helped the currency soar more than 14% so far this year, making it the best performing currency in Latin America. Its gains outpaced even those of the real, which benefited from the Brazilian central bank’s early fight against inflation.

Uruguay’s currency was also the world’s fourth best performer after the Armenian dram, Afghan afghani and the Georgian Lari, according to data compiled by Bloomberg.

Weakening Pressure

As the end of the year approaches, expectations are rising that Uruguay’s central bank will adopt a less restrictive stance in 2023 after an expected half-point increase next week to 11.75%. Inflation has slowed for two consecutive months, falling to 8.5% in November, just below its 20-year average.

If the central bank begins to lower its policy rate, “financial flows supporting the Uruguayan peso are likely to weaken during 2023,” TPCG Valores chief economist Juan Manuel Pazos and strategist Santiago Resico wrote in a note.

The peso is likely to weaken, but less than any possible easing of inflation next year would suggest, and the economy will perform relatively well at an exchange rate between 40 and 42 to the dollar, said Jeronimo Nin, who manages about US$1.2 billion at local brokerage Nobilis.

Walter Stoeppelwerth, senior strategist at Montevideo-based brokerage Gletir, said the peso could reach between 41 and 42 to the dollar in the first quarter as dollar inflows from summer tourism fade. Rising imports and falling exports suggest the currency is overvalued, he said.

“The sky high real effective exchange rate implies that there could be a correction after the summer tourist season,” Stoeppelwerth asserted.

Export Squeeze

Exporters have become increasingly critical of the exchange rate, saying an overvalued peso is costing them business. Government data shows significant drops in the value of exports in each of the last two months.

“A free market exchange rate is good, but sometimes you have to intervene to improve the performance of exporters,” Juan Martinez Escrich, president of the Confederation of Business Chambers of Uruguay (CCE), told reporters in Montevideo.

Labat acknowledged in early December that the exchange rate is a “concern” for the central bank and indicated that intervention is always on the table, but that it must be used with great caution. We don’t rule out its use”, he said.

Read more at Bloomberg.com