Bloomberg — Superlatives followed one after another in 2021′s wild ride for U.S. stock investors.

The most all-time highs in 26 years. Triple-digit rallies in some small caps thanks to retail-trader frenzies. A $1 trillion rout after China cracked down on some of its biggest companies.

In a year marked by a waning pandemic, new Covid variants, supply chain disruptions and a fits-and-starts U.S. economic recovery, the S&P 500 smashed old records en route to a 26% gain and the creation of $8.6 trillion in value.

The benchmark’s steady march higher has helped push it to a fresh record 68 times this year, the second-most ever, topped only by 1995. Put another way, the S&P managed a record close on nearly 30% of all trading days in 2021.

Here’s a look at some of the other standout moves in stocks this year:

Meme Mania

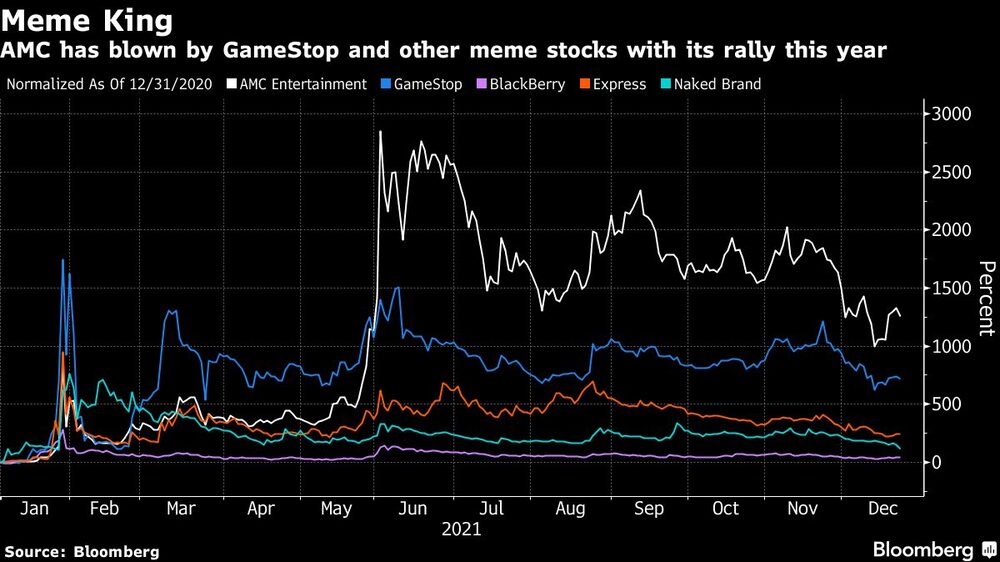

Flush with cash and trapped at home due to the ongoing pandemic, retail traders started the year by supercharging the so-called meme stocks. GameStop Corp. and AMC Entertainment Holdings Inc. were emblematic of the movement as investors flooded social media platforms with calls to buy shares of the struggling companies.

AMC Entertainment has skyrocketed more than 1,200% and GameStop rallied about 700%.

While dozens of other stocks were swept up in the market over the year, many failed to sustain their initial surge. Retail favorites including ContextLogic Inc., Clover Health Investments Corp. and Workhorse Group Inc. all find themselves down more than 70% this year as investor enthusiasm faded.

Archegos Yard Sale

The meme craze still paled in comparison to the chaos that ensued following the collapse of Bill Hwang’s Archegos Capital Management.

A cascade of forced liquidations of positions held by Hwang hammered stocks like ViacomCBS Inc., Discovery Inc., Vipshop Holdings Ltd. and Tencent Music Entertainment Group -- all of which plunged more than 30% over a week as banks rushed to cover billions of dollars in exposure.

IPO Record

The explosion of SPAC listings has helped drive initial public offerings on U.S. exchanges to a record. Nearly 1,110 firms made their trading debuts in 2021, raising roughly $337 billion. Electric pickup maker Rivian Automotive Inc. led the way, raising $13.7 billion in November in what was the 12th-biggest IPO of all time across all exchanges, data compiled by Bloomberg show. South Korean e-commerce giant Coupang Inc. came in second with its $4.6 billion listing in March.

Didi Global Inc. rounded out the top three with a $4.4 billion debut that has since become one of the most disastrous ever. The shares have plunged 60% amid continued regulatory pressure from China, which culminated with the company announcing earlier this month that it would delist from U.S. exchanges.

China Crackdown

Didi’s selloff is a microcosm of the rout experienced by U.S.-listed Chinese stocks in 2021 as regulators in Beijing mounted a sweeping crackdown on the nation’s companies. The Nasdaq Golden Dragon China Index has plunged 44% since the start of the year, erasing more than $1 trillion in market value. Education stocks like Tal Education Group and New Oriental Education & Technology Group Inc. have been the worst hit, with losses in excess of 85% each.

-- With assistance from Drew Singer.