Bloomberg — An Asia-Pacific stock gauge was steady Monday and US equity futures pared a climb as tightening monetary policy kept sentiment in check.

Bourses in Japan and Australia fluctuated while South Korea shed more than 1%. Both S&P 500 and Nadsaq 100 contracts were in the green but off early session highs.

Bitcoin held above $20,000 after climbing 16% Sunday to retake that closely-watched price level following a Saturday swoon.

A volatile crypto slump has become emblematic of the pressure on a range of assets from sharp Federal Reserve interest-rate hikes to tame high inflation.

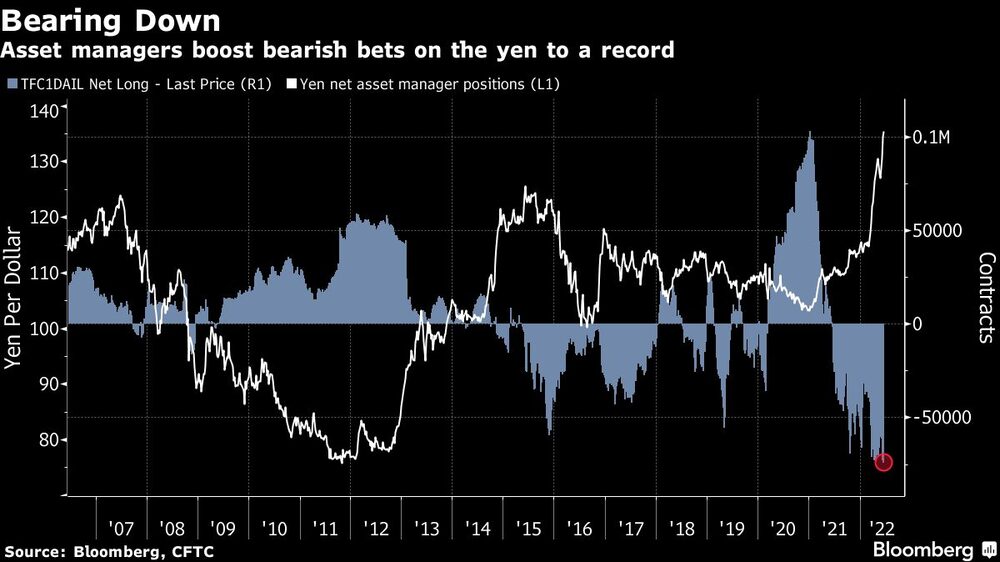

The dollar was mixed against key peers. The yen dropped on the contrast between super-loose Japanese monetary policy and the hawkish Fed.

Crude oil steadied from a near-7% Friday plunge. Treasury futures slipped -- there’s no cash trading as Wall Street is closed Monday for a holiday.

Markets are set to remain on edge amid elevated price pressures and concern that monetary tightening in a range of nations portends more losses.

“Data over the coming months will indeed point to the need for a greater degree of tightening, and market prices will need to adjust,” Sonal Desai, chief investment officer at Franklin Templeton Fixed Income, wrote in a note.

In the latest Fed commentary, Governor Christopher Waller said he would support another 75-basis-point rate increase at the central bank’s July meeting should economic data come in as he expects.

Bank of Cleveland Fed President Loretta Mester said the risk of a US recession is increasing, adding it will take several years to return to the 2% inflation goal. Fed Chair Jerome Powell is due to appear before US lawmakers this week.

China Outlook

In China, Bloomberg Economics expects banks to keep loan prime rates steady. Chinese stocks have recently emerged as a bright spot amid a global rout, aided by the nation’s pledge of policy support to shore up the economy.

President Joe Biden on Saturday said he’ll be talking to his Chinese counterpart Xi Jinping “soon” and is weighing possible action on US tariffs on China that were imposed by the Trump administration.

“We’re in the process of doing that,” Biden told reporters on Saturday when asked whether he had decided to lift any of the tariffs. “I’m in the process of making up my mind.”

What to watch this week:

- China loan prime rates, Monday

- RBA minutes, Governor Philip Lowe due to speak, Tuesday

- Fed Chair Jerome Powell semi-annual Senate testimony, Wednesday

- Bank of Japan April minutes, Wednesday

- Powell US House testimony, Thursday

- US initial jobless claims, Thursday

- PMIs for Eurozone, France, Germany, UK, Australia, Thursday

- ECB economic bulletin, Thursday

- US University of Michigan consumer sentiment, Friday

- RBA’s Lowe speaks on panel, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 9:23 a.m. in Tokyo. The S&P 500 rose 0.2% Friday

- Nasdaq 100 futures rose 0.6%. The Nasdaq 100 rose 1.2% Friday

- Japan’s Topix index added 0.1%

- Australia’s S&P/ASX 200 index was little changed

- South Korea’s Kospi fell 1.4%

- Euro Stoxx 50 futures increased 0.2%

Currencies

- The Bloomberg Dollar Spot Index was steady

- The euro fell 0.1% to $1.0494

- The Japanese yen was at 135.21 per dollar, down 0.1%

- The offshore yuan was at 6.7076 per dollar

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.23% Friday

Commodities

- West Texas Intermediate crude rose 0.5% to $110.15 a barrel

- Gold was at $1,838.61 an ounce