Bloomberg — Mexican President Andres Manuel Lopez Obrador was pilloried for his stinginess at the outbreak of the pandemic. His unwillingness to dole out anything but the bare minimum of emergency aid left millions of Mexicans to sink deeper into poverty.

But now, at least some pay-off for those sacrifices is emerging. Mexico has maintained access to international bond markets at a time when many other developing nations find themselves cut off.

With US interest rates surging, investors have become very selective. They often flat-out refuse to buy bonds offered by countries with deteriorating finances. Thanks in part to AMLO’s austerity, Mexico is for the most part in sound shape. Its budget deficit and debt levels are below the median for its peers.

So when Mexican finance officials have tested demand abroad for the country’s bonds, they’ve found plenty of willing buyers. Just last week, Mexico sold 75.6 billion yen ($553 million), bringing the government’s haul from overseas markets this year to $9.47 billion.

Much of those sales, to be clear, were just to roll over maturing debt. But at a moment like this -- when hard currency is suddenly becoming a scare resource across much of the world -- even a simple refinancing of debt is an important step toward maintaining a steady flow of money into a country, shoring up the local currency and helping curb inflation. The peso (MXN) is one of just a handful of currencies in the world to avoid sinking against the dollar this year as the Federal Reserve ratchets up interest rates.

AMLO’s “fiscal prudence then allowed the country to navigate this better,” said Carlos Legaspy, the chief executive officer of Insight Securities. “For debt investors he has been good: Credit worthiness has been maintained at an attractive rate of return.”

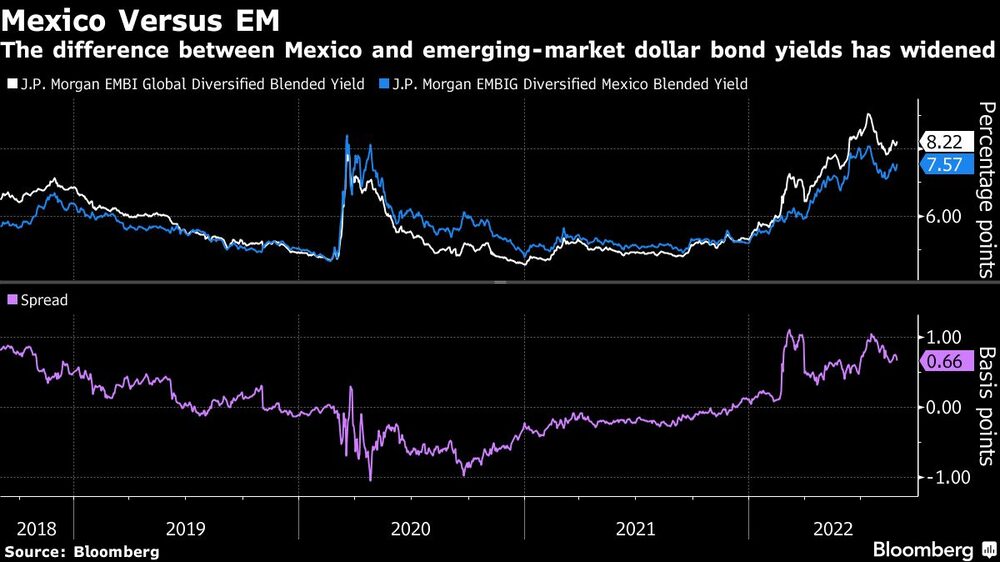

Mexican dollar debt yields about 7.6% on average, lower than the 8.2% for emerging-market sovereign bonds as a whole, according to JPMorgan Chase & Co. indexes. Mexico’s discount has widened this year and hovers near the biggest since late 2018, before AMLO took office. The extra yield on emerging-market dollar bonds over Treasuries has widened by 144 basis points during the past year, while Mexico’s spread rose at about one-third that pace.

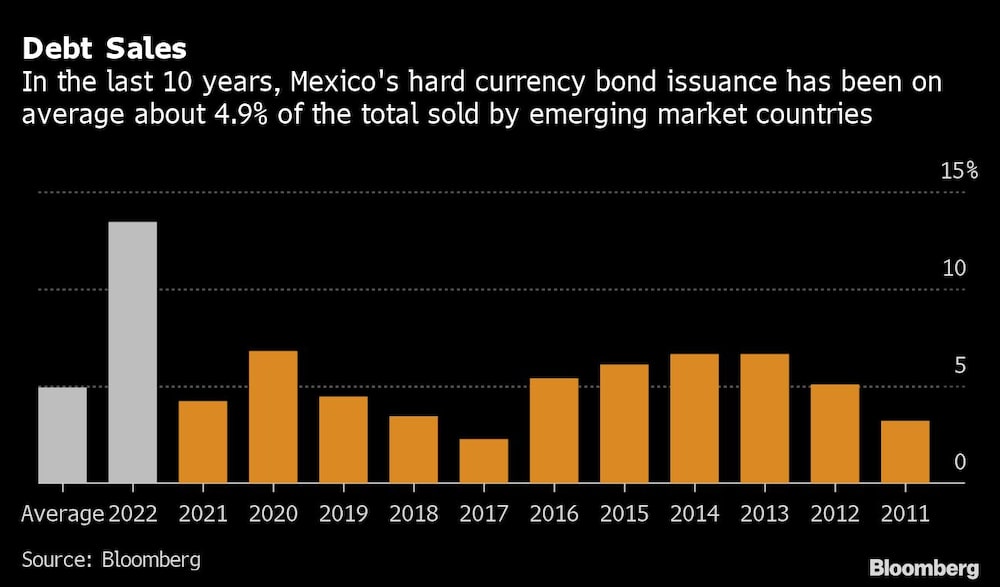

The country has issued more hard-currency debt than any other in the developing world this year, accounting for 13% of total sales, up from an average of 4.9% over the past 10 years, according to data compiled by Bloomberg.

As governments around the globe rushed to spend to salvage their economies from the pandemic chaos, Mexico’s fiscal deficit only rose to 2.3% of gross domestic product from 1.8% in 2020. The median for similarly rated peers climbed to 5.8%, according to Fitch Ratings data.

Even after the three major rating companies cut Mexico’s score early into the pandemic, it kept its investment-grade status. In July, S&P Global Ratings boosted its outlook to stable from negative, citing Mexico’s fiscal prudence. Moody’s Investors service downgraded the nation by a notch, saying the pandemic would weigh on growth prospects in coming years.

Indeed, Mexico had its worst economic contraction in almost a century during the Covid crisis, and growth remains anemic. The median forecast of economists surveyed by Bloomberg is for an expansion of 2% in 2022. Meantime, the International Monetary Fund predicts the Mexican economy will grow just 2.4% this year, below the global estimate of 3.2%.

“They decided to keep fiscal discipline and deal with the consequences in terms of economic activity,” said Mauro Roca, managing director of emerging markets at TCW Group Inc. in Los Angeles. “Mexico has benefited now from keeping that fiscal discipline.”

‘Least Dirty Shirt’

It’s also far removed from the war in Ukraine, and unlike its neighbors in South America, there’s little political uncertainty clouding the country’s outlook in the near term.

Colombia’s new leftist President Gustavo Petro has promised to halt exploration of oil -- the nation’s biggest export -- sending yields on local bonds to record highs last month. In Chile, jitters over a referendum to approve a constitutional draft sent five-year credit-default swaps soaring to briefly surpass lower-rated Mexico for the first time ever. Meantime, investors are closely watching an upcoming election in Brazil that will set the course for government spending for years to come.

Despite all that, creditors get a juicier reward for holding Mexican debt than that of its major Latin American peers. The nation’s spread over similar US Treasuries is about 4 percentage points, higher than that of Chile, Peru, Brazil and Colombia, according to a JPMorgan gauge.

“It’s sort of like the least dirty shirt of the region,” said Valerie Ho, a portfolio manager at DoubleLine Group in Los Angeles.