A roundup of Tuesday’s stock market results from across the region

📉 A bad day across the board for LatAm:

The latest inflation data from the United States put an end to the risk appetite that had boosted Latin American stock markets on Monday. The slowdown in the cost of living in the US at a slower pace than expected generated a wave of sales in the region’s markets, which experienced a day of losses.

Brazil’s Ibovespa (IBOV) was the hardest hit market and closed the day with the sharpest drop in Latin America, with shares of Petrobras (PETR3; PETR4) and Vale (VALE3) among those suffering a fall.

The prices of the main commodities also fell after being affected by risk aversion sentiment.

The Mexican stock market sealed the second largest drop in Latin America after the S&P/BMV IPC (MEXBOL) fell, dragged down by the performance of the materials, communication services and finance sectors.

Shares of Volaris (VOLARA), Cemex (CEMEXCPO) and Grupo México (GMEXICOB) were among those with the sharpest losses.

“The CPI report was a negative event for equity markets,” wrote Matt Peron, director of research at Janus Henderson Investors. “The higher-than-expected data report means we will have continued pressure from Fed policy through rate hikes.”

🗽 On Wall Street:

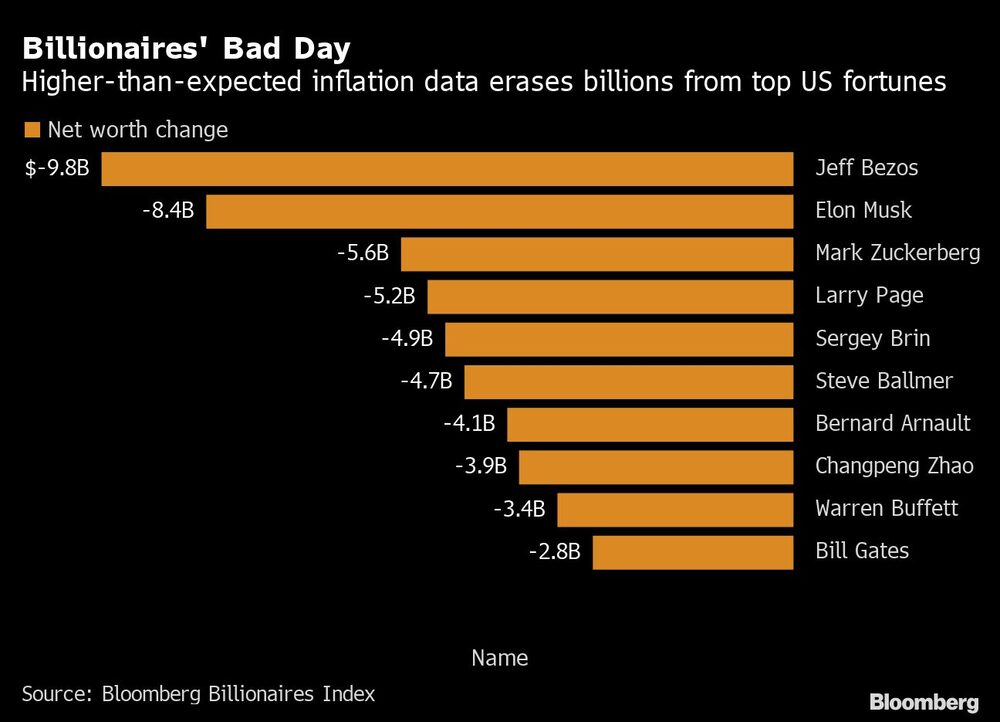

A broad-based selloff sent equities to their worst day in more than two years after hotter-than-expected inflation data fueled bets on a jumbo hike by the Federal Reserve next week. Treasury yields surged and the dollar gained.

Across the board selling sent the S&P 500 down more than 4%, while the tech-heavy Nasdaq 100 losses surpassed 5% as yield-sensitive stocks took the biggest hit. Both benchmarks suffered their worst one-day routs since 2020. Swaps traders are now fully pricing in a rate increase of three-quarters of a percentage point, with wagers rising for a similar move in November and policy rates ultimately reaching around 4.3% early in 2023.

The S&P 500 sank 4.32%, the Dow Jones Industrial Average 3.94% and the Nasdaq Composite (CCMPDL) 5.16%, the three indices’ sharpest fall since June 2020.

The two-year Treasury yield, the most sensitive to policy changes, jumped as much as 22 basis points, pushing it more than 30 basis points above the 10-year rate and deepening an inversion in what is generally a recession warning.

The consumer price index increased 0.1% from July, after no change in the prior month, Labor Department data showed Tuesday. From a year earlier, prices climbed 8.3%, a slight deceleration but still more than the median estimate of 8.1%. So-called core CPI, which strips out the more volatile food and energy components, also topped forecasts.

“Overall, today was a surprising day against the trend of what had appeared to be some moderation across most indicators of growth and pricing pressure, so the Fed’s job is clearly not finished,” Rick Rieder, the chief investment officer of global fixed income at BlackRock Inc., the world’s biggest asset manager, wrote.

“We think the Fed will pause the rate hiking cycle potentially at year-end, but maybe now the central bank will have to wait a bit longer to do that after having reached a restrictive policy stance,” he added.

According to Seema Shah, chief global strategist at Principal Global Investors, “headline inflation has peaked but, in a clear sign that the need to continue hiking rates is undiminished, core CPI is once again on the rise, confirming the very sticky nature of the US inflation problem”.

“In fact, 70% of the CPI basket is seeing an annualized price rise of more than 4% month-on-month. Until the Fed can tame that beast, there is simply no room for a discussion on pivots or pauses,” she added.

Twitter approves Musk deal

On the corporate front, Twitter Inc. (TWTR) shareholders approved Elon Musk’s proposed $44 billion buyout, paving the way for a trial next month.

JPMorgan Chase & Co. said deal fees may fall by half in the third quarter, and Citigroup Inc. warned trading revenue in the third quarter will likely drop as a slowdown in its business dedicated to securitized products crimps fixed-income trading revenue.

The selloff in stocks after the latest inflation data erased nearly all the gains in the S&P 500′s biggest four-day surge since June. The reversal cast a dark shadow over the debate about the outlook for the global economy and markets. Bank of America Corp.’s latest survey showed the number of investors expecting a recession has reached the highest since May 2020.

A gauge of the dollar climbed more than 1%, advancing against all of its Group-of-10 counterparts. Bitcoin tumbled more than 10%, the biggest decline since cryptocurrencies plunged in June, as the broad-based selloff in financial markets spilled over into the digital-asset sector.

On the currency markets, the Bloomberg Dollar Spot Index rose 1.2%, the euro fell 1.5% to $0.9973, the British pound fell 1.6% to $1.1500, and the Japanese yen fell 1.2% to 144.49 per dollar.

🔑 The day’s key events:

Expectations that the Federal Reserve will further tighten its monetary policy hit oil prices, as interest rate hikes could hurt economic growth and thus oil demand.

Prices halted a three-day rally after hitting six-month lows last week. However, today’s session losses were pared after the market learned that the US may start buying more crude once benchmark WTI crude oil falls below $80 per barrel.

President Joe Biden administration officials, quoted by Bloomberg, explained that the objective would be to replenish the country’s strategic reserves, which are now at the lowest level since 1984.

While the president ordered in March the release of 180 million barrels in an effort to control high prices, he is now aiming to slow down those releases ahead of next winter.

White House officials are trying to reassure oil producers that the Biden administration will not allow prices to collapse, so buying crude would help support the market, the Bloomberg report added.

🍝 For the dinner table debate:

Former head of security at Twitter, Peter Zatko, appeared before the Senate Judiciary Committee on Tuesday, and said the social network’s security failures have been so serious that they have threatened the security of the United States.

Zatko said Twitter was decades behind necessary security updates and described the situation as a “ticking time bomb of vulnerabilities,” Bloomberg reported.

“Twitter’s insecure handling of its users’ data (...) has created a real risk to tens of millions of Americans, the American democratic process, and US national security,” Zatko said.

He also said the company’s leaders “repeatedly covered up security flaws, misleading regulators and lying to users and investors.”

-- Carlos Rodríguez Salcedo, a content producer at Bloomberg Línea, and Stephen Kirkland of Bloomberg News, contributed to this report.